Given the fact that Bitcoin received the third halving, the price of the asset reacts with a noticeable increase of 13%. As a result, the number of profitable days of the primary cryptocurrency has increased to more than 93%, the data monitoring website reports.

Almost all BTC positions are in profit

The historical significance of Bitcoin halving draws much attention. This was no exception. While there were many predictions that the price would fall, mainly due to sales pressure caused by miners, BTC has so far been challenging all of them, gaining more than $ 1000 since its miners halved production.

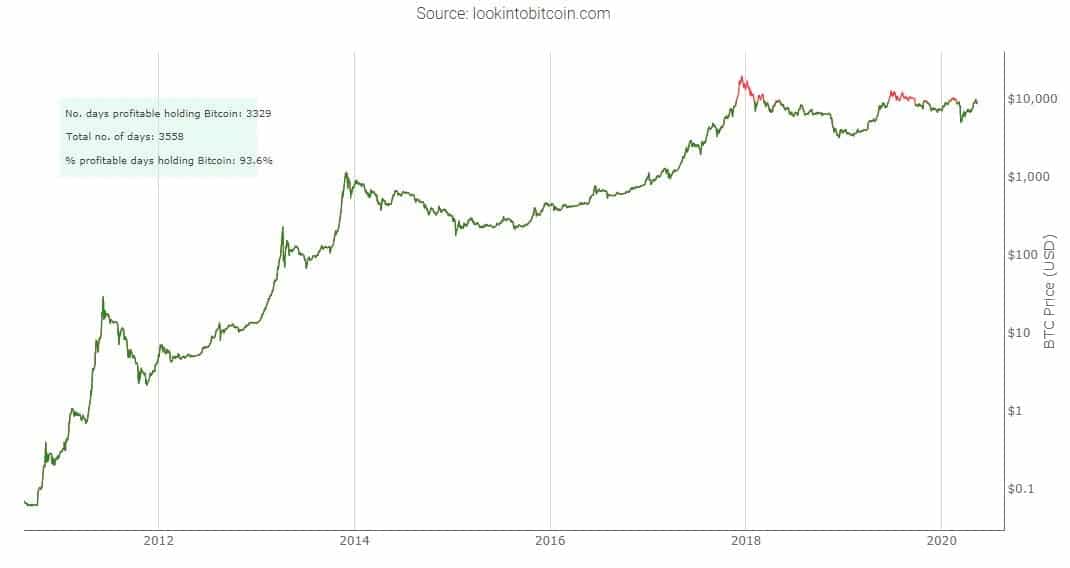

According to A popular cryptocurrency monitoring resource, the price of which is where it is now, the number of profitable days in which BTC is held has increased since August 2010 to 93,6%. This means that Bitcoin was in the green zone at 3329 of 3558 days.

Bitcoin Profitable Days. Source: LookIntoBitcoin

HODLs don't sell

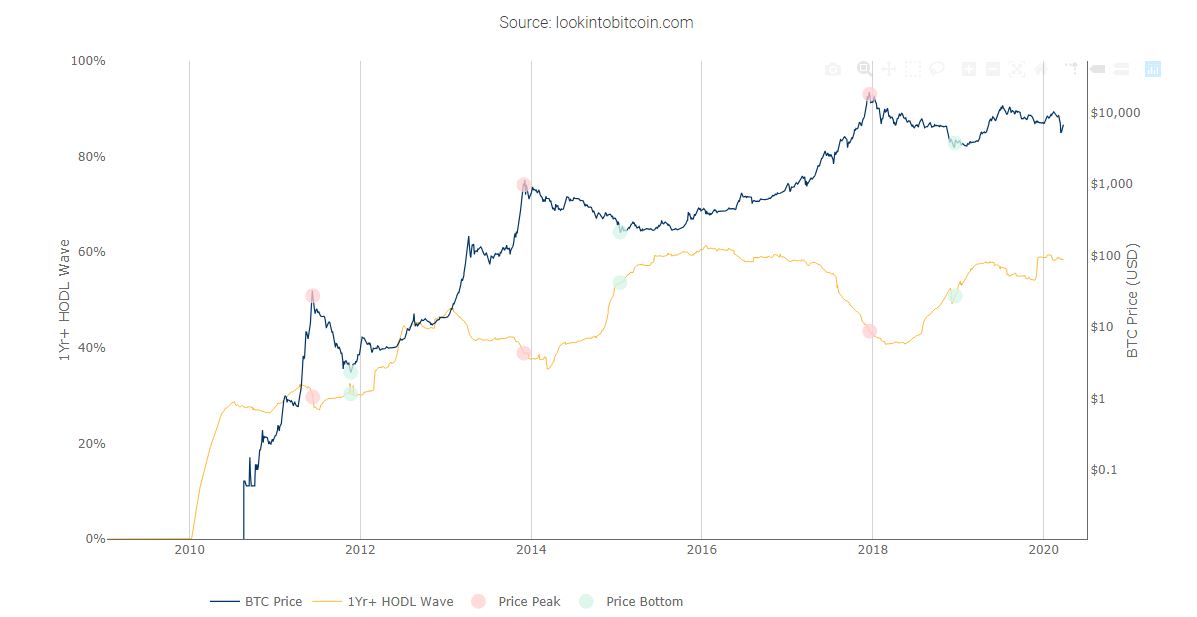

Another compelling chart explores the behavior of Bitcoin HODLers. More specifically, he looks at the number of BTC addresses that have not moved their coins for one or more years.

As you can see in the above chart, the so-called “annual HODL wave” has almost reached its historical maximum. The latest recorded data was at 58%, while in January 2016, a few months before the second reduction, this figure was at 61.

In addition, the chart also connects price movements with the HODL wave. Starting in the early days of 2011, when BTC peaked above $ 30, the percentage of the wave declined, which means that HODLers were selling more. However, a few months later, when BTC hit the bottom at $ 2,50, the percentage of HODL increased.

The same is true for several other distinguishing cases. Firstly, this happened at the end of 2013, when bullish growth occurred and a subsequent fall in prices followed. Then a similar result was noted during the parabolic price increase 2017/2018. When BTC reached its all-time high of $ 20, the annual HODL wave fell to about 000%. When the price hit the bottom in the following months, the wave rose again to 40%.