In May, the 2020 Bitcoin The third event (halving or halving) will take place, reducing block rewards from 12,5 BTC to 6,25 BTC. BTC inflation will drop to its lowest level when fewer bitcoins come into circulation.

Currently, the number of addresses hosting more than 100 BTC, which is equivalent to about $ 1 million, is just over 14. Thus, at present there are at least 000 bitcoin millionaires.

However, if Bitcoin follows its previous growth pattern and can achieve more than 10000 percent growth over the months during which its third will be halved, then the threshold for becoming a Bitcoin millionaire can be significantly reduced.

Instead, according to recent forecasts, anyone with at least 2,45 BTC today can join the Bitcoin Millionaire Club in the coming years.

Creating a Bitcoin Millionaire

According to renowned trader and technical analyst Rekt Capital, between the lowest and highest price of Bitcoin around the first halving, the first and most important cryptocurrency achieved an incredible increase of 13 percent – rising from a low of $378,9 to a peak of $2,01. $.270,94 over a time span of 511 days.

Thus, anyone who owned Bitcoins worth about $ 7 (~ 474 BTC) at the bottom of this price action and held it for 3,718 days could be considered a Bitcoin millionaire.

How much has # Bitcoin rallied as a result of each of its Halvings to date?

Halving 1:

+ 13,378 %

Halving 2:

+ 12,160 %

If BTC rallies anything between 12,160 – 13,378% as a result of Halving 3…

price of one $ BTC will be $385,000 – $400,000https://t.co/4StGraQAaQ#Crypto

- Rekt Capital (@rektcapital) January 17, 2020

Similarly, in the 1064 days following the second bitcoin halving, which occurred in July 2016, bitcoin gained an incredible 12% between the lowest and highest price categories. During this time, Bitcoin rose from a low of $ 160,9 to $ 164,01 at the peak of the 20,074 bull rally.

Because of this, anyone who had bitcoin worth at least $ 8 when it was valued at $ 223 and kept that amount until bitcoin peaked at more than $ 164,01 could would be considered a bitcoin millionaire at that time.

Thus, assuming that Bitcoin will reach the average growth rate achieved in previous years, this may be due to an increase of 12 percent between the highs and lows of this third half-period of halving. Since Bitcoin hit a low of $ 769,9 in December 2018, multiplying this value by 3 percent gives us an approximate maximum value after halving about $ 198.

At its current value of $10, Bitcoin has gained 100 percent since hitting a low of $215,8. So it could still rise another 3 percent from its low price ($198) or 12 percent at its current price ($554,1) to $3198 . Because of this, anyone who owns a total of 4 BTC – or $039,6 worth of BTC today – has a chance of becoming a millionaire in the coming years.

While achieving a net worth of 2,45 BTC may seem like a daunting task, depending on your circumstances, there are several ways to quickly narrow the gap and quickly increase your BTC assets.

How to catch up

While it is certainly possible to directly buy a large amount of BTC with various fiat currencies or other cryptocurrencies on platforms such as XCOEX and Coinbase, many investors may not have the necessary capital for this, or simply do not want to risk entering the market with such a significant amount of money.

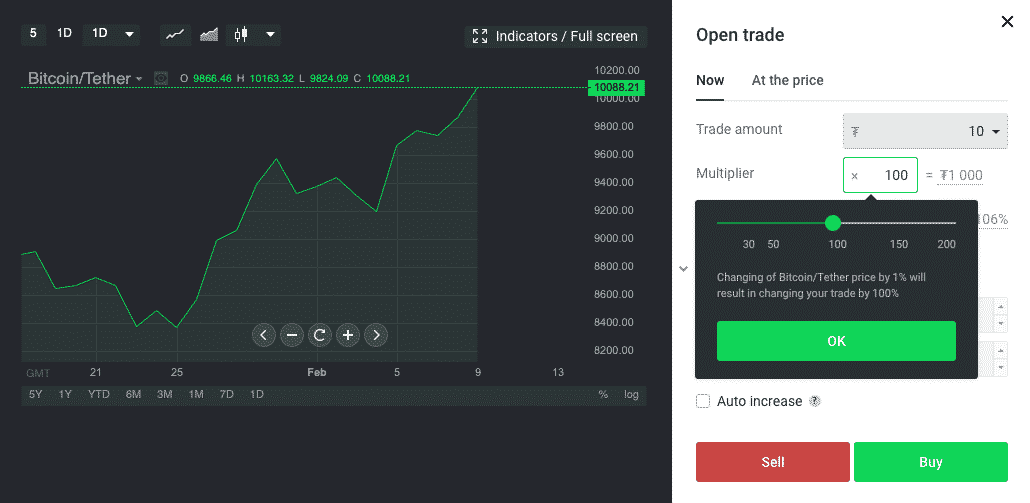

Instead, thanks to the emergence of cryptocurrency derivatives exchanges such as StormGain, you can increase your exposure to market changes by 200 times by trading bitcoin futures. These bitcoin futures are simple trading tools that allow you to open long or short positions in the market, taking advantage of leveraged trading.

Thus, trading with a leverage of 200x, one could open a 2,45 BTC position with just 0,01225 BTC, or about $ 130. Due to the leverage benefits, the value of that position will be multiplied 200 times the rate of change at which the Bitcoin market is moving, which means that a positive five percent price move will give -percentage profit, whereas a positive one-percent price movement will give 1000 percent profit, and so on.

Play safe

However, even if Bitcoin will grow by more than 4000 percent in the coming months or years, there will almost certainly also be periods of significant decline between them. Thus, to give yourself more room for respite and to protect yourself from margin calls during this time, you can reduce your leverage to a more reasonable level.

With a leverage of 50 times, opening a position at 2,45 BTC will require a total investment of about $ 460, while opening a position with a leverage of 25 times will increase to $ 920. Because of this, even those who want to keep both leverage and investment low can still benefit from any potential benefit of halving. Similarly, when you enter at the right time and withstand any transitional downturns, there is the potential to turn these investments into a $ 1 million position.

Based on the foregoing, there is no guarantee that Bitcoin will equal or even repeat the bullish momentum observed around the halving event in previous years. In this regard, it would be advisable to closely monitor your position and the market during this time, using carefully selected stop loss to protect yourself from any unexpected adverse price movements.