- How many bitcoins are left to mine?

- Bitcoin halving

- The total supply of bitcoin

- How many bitcoins exist?

- final figure

- Is the amount of Bitcoin fixed?

- An incentive to increase the total supply of bitcoins

- Changing the bitcoin supply limit

- What Happens When All Bitcoins Have Been Mined: Impact on Stakeholders

- Miners

- Retail Investors and HODLers

- Institutional investors

- Governments

- Сonclusion

Bitcoin continues to gain momentum and popularity. Just a year and a half ago, pundits and tech experts were optimistic about its future growth, but few expected Bitcoin to take off the way it did in 2021. The trend may continue further. More than 19 million bitcoins have already been mined. This brings us to the most perplexing question: What happens when all bitcoins are mined?

With less than 2 million bitcoins left, this is a real concern for everyone involved. Here is an explanation of what will happen when all the remaining bitcoins are mined.

How many bitcoins are left to mine?

As of June 2022, there are about 19,07 million bitcoins in circulation. This means that there are only 1,92 million bitcoins left to be mined, and more than 90% of all bitcoin has already been mined.

When bitcoin inventor Satoshi Nakamoto created the virtual currency in 2008, the total number of bitcoins was 21 million. One of the reasons for limiting the number of bitcoins was the desire to create a currency without inflation. Because bitcoins are meant to be transacted just like fiat currency, too many bitcoins in the market could cause the price to fluctuate wildly.

With this in mind, the inventor set a limit of 21 million bitcoins in order to control the supply and therefore future price fluctuations.

One way to drive the mechanism was to gradually release bitcoins without flooding the market with all 21 million bitcoins at once. To do this, the Bitcoin code was designed in such a way that only a fixed number of Bitcoins can be mined each year until the limit of 21 million Bitcoins is reached.

New Bitcoins are released into circulation when a new block is mined and added to the blockchain. Bitcoin Mining programmed with a difficulty algorithm that helps keep the entire system stable by maintaining a 10-minute period for finding new blocks. This difficulty is updated every 2 blocks, or about every two weeks, as the network itself determines whether miner activity has increased or decreased, and reconfigures the bitcoin mining difficulty so that the time to find each block is approximately 016 minutes.

Bitcoin halving

To ensure a gradual influx of bitcoins, Satoshi Nakamoto introduced the concept of halving. This mechanism reduces the number of available bitcoins entering circulation by half every three years and nine months. If the trend continues, this means that almost all 2078 million bitcoins will be mined by the end of 21. In other words, by then there will be no more bitcoins left to mine.

For those wondering what will happen when all bitcoins are mined, there is some confusion surrounding the exact end date for the total supply of bitcoins. If you search Google for the answer, the date of this event will most likely be listed as 2040, not 2078. This is partly because anecdotal studies show that the halving occurs every four years rather than every three years and nine months. Most likely, if the halving trend continues, and everything else remains unchanged, the supply limit of bitcoin will be reached around 2078.

The next bitcoin halving is estimated to take place in March or April 2024, when the protocol will repeat the halving again, lowering the block reward to 3,125 BTC.

The total supply of bitcoin

How many bitcoins exist?

Every day there are fewer bitcoin blocks available for mining, as the end date for bitcoin mining is gradually approaching.

However, it is important to understand that not all bitcoins mined to date are in circulation, further reducing the total supply of bitcoins in circulation at any given time. There are many reasons why the current supply of bitcoins does not match the total amount of bitcoins mined.

One of the main reasons is the way Bitcoin is stored. Because the owner needs to protect their bitcoins with wallets and passwords, there is no way to access the stored bitcoins if the owner dies without giving someone else access to the password. Bitcoin can also become permanently inaccessible due to other mistakes by its owners. Bitcoin is unlike other assets: it is almost impossible to return it without the consent of the owner.

According to a recent study by the New York Times, almost 20% of bitcoins are in inaccessible wallets. The total value of these locked bitcoins is estimated to be around $140 billion. These bitcoins will most likely remain trapped indefinitely, which affects the total amount of bitcoins in circulation.

The next time someone asks you how many bitcoins are in circulation, the answer is simple: take the negotiable supply, which is around 19 million at the time of writing, and then subtract all the bitcoins stuck in unreachable wallets.

final figure

Even if there were no locked bitcoins, it is theoretically impossible to reach the figure of 21 million when all the bitcoins are mined. In reality, the final figure will be very close to the Bitcoin supply limit. This is because the supply of Bitcoin is never expressed in exact numbers. Instead, the Bitcoin code rounds decimal points to the nearest whole number. As a result, the offer of 6,2589 bitcoins will be represented by 6 bitcoins.

Bitcoins are divided into smaller units known as Satoshi. One satoshi is one 1/100 millionth of a bitcoin. Because of these smaller units – and the rounding of numbers – experts suggest that the supply limit for bitcoins will be capped at 20 instead of 999 million bitcoins.

Is the amount of Bitcoin fixed?

The total supply of Bitcoin and the maximum number of Bitcoins to mine are fixed – unless the parties concerned decide to do something about it. When Satoshi Nakamoto invented virtual currency, he did it as an open source project. For those who are worried about what will happen when all the bitcoins are mined, and what consequences this may have if the parties involved decide to change the code and increase the bitcoin limit, this is possible if the majority agrees. While there is an incentive to do so, the potential impact of such a change is highly debatable and ambiguous.

An incentive to increase the total supply of bitcoins

Bitcoin mining is popular because there is a huge incentive for miners to successfully mine the maximum amount of bitcoin for their own benefit. The incentive is paid out in the form of a block reward, which is a fixed amount of Bitcoin distributed among the miners. In addition to receiving Bitcoin, miners also receive a portion of transaction feesassociated with the block.

When the currency was launched, the reward for confirming a block of transactions was 50 Bitcoins. After four years, this amount has decreased to 25 bitcoins, and this cycle will continue until there are no bitcoins left to mine.

Currently, after three timeframes, miners receive 6,25 BTC for block confirmation. Despite the decrease in reward, the higher value of each bitcoin offsets the effect of the halving. Transaction fees have also risen as a result of Bitcoin going mainstream. While fees are expected to rise Bitcoin transactions, it is not necessary that all Bitcoin transactions take place on the blockchain. Additional levels such as Lightning Network, provide cheaper and faster ways to transfer Bitcoin and will likely drive mass adoption.

Undoubtedly, getting a block reward is the main incentive for miners. This monetary incentive not only keeps miners interested in mining, but also contributes to the prosperity of the entire ecosystem. Under these conditions, it is quite logical to wonder what can happen when all bitcoins are mined.

Some experts believe that the incentive is not a problem at all - after all, transaction fees, which are only 6% of the existing income of miners, will increase significantly, compensating for the loss of block rewards. However, this answer does not satisfy the many stakeholders who are actively involved in the life of the bitcoin industry. They still want to know what will happen when all 21 million bitcoins are mined and if something can be done about how many bitcoins will exist in the future.

Changing the bitcoin supply limit

It is theoretically possible to change the total amount of Bitcoin by changing the main code. Since bitcoin itself is software, experts agree that it can be changed. To do this, developers, stakeholders and the entire community will need consent to change the code. If an agreement is reached, developers will write code to integrate these changes into Bitcoin Core.

In order for everything to work properly, the next step is to ensure that all nodes on the Bitcoin network accept the changes – or are forced to leave the network. However, getting each node to accept changes is not a trivial task, since the Bitcoin platform was primarily designed as a standalone system that did not require changes. At this stage, developers will have to deal with a hard fork. A hard fork is a consensus change that makes a previously invalid behavior valid. In an ideal scenario, all nodes will be updated to accept the proposed changes.

In another scenario, only a few bitcoin users would support the existing limit of 21 million bitcoins. In this situation, miners and nodes that did not accept the changes would continue to run on the existing Bitcoin platform. These dissidents will likely compete with the new Bitcoin platform for market share. This is known as a controversial hard fork as it creates another chain that splits the miner base and one such example is Bitcoin cash.

What Happens When All Bitcoins Have Been Mined: Impact on Stakeholders

At present, no one can accurately predict what will happen when all available bitcoins are mined. Regardless of any future efforts to change the underlying core of Bitcoin, experts continue to speculate about the future after the maximum limit has been reached.

Some analysts support the idea of using higher transaction fees to compensate for the lack of blockchain rewards. New technologies will likely help lower the cost of mining, which will ultimately lead to higher profits for miners. Another theory suggests that Bitcoin platforms will only be used for large transactions of very high value, which will provide enough revenue to keep stakeholders happy. There are other theories that talk about proof-of-stake and miner cartels.

From a stakeholder perspective, below is a brief overview of what will happen when all bitcoins are mined.

Miners

Miners are responsible for maintaining and updating the Bitcoin blockchain through mining. Mining is the process of verifying transactions and adding new blocks to the Bitcoin network. To do this, miners have to solve complex mathematical puzzles, which currently require expensive ASIC computers to produce large computing power, and also consume a lot of electricity.

To compensate for their efforts and costs in securing the network, miners receive block rewards (a set number of bitcoins) and transaction fees.

Currently, most miners and mining firms use block rewards to offset mining costs and still make a profit. But since mining rewards are halved every four years, Bitcoin mining costs are expected to eventually exceed the rewards earned by miners much sooner than the fixed supply is reached.

However, if the price of bitcoin rises enough over time, it could offset the decline in blockchain rewards. Currently, using a regression model, the average cost of bitcoin mining by miners is approximately $17, and the most efficient miners using the AntMiner S600 XP can break even between $19 and $7 depending on the complexity of the network and the cost of electricity. All previous generation miners from 700 to 10 are no longer profitable, and many mining rigs from 560-2016 have also ceased to be profitable.

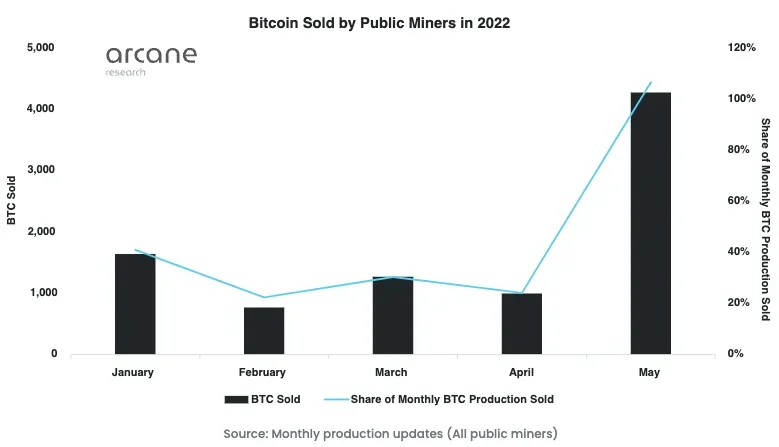

At the time of this writing, companies that have ambitious growth plans in 2021 and have placed large orders for bitcoin mining hardware and built expensive infrastructure may not be profitable and may be forced to constantly sell their bitcoin holdings or borrow against bitcoin. ASIC miners or even infrastructure to stay afloat.

With the next bitcoin halving around 2024, these break-even prices will double unless more efficient mining rigs are built or cheaper sources of electricity are found, and this could spell disaster for miners if bitcoin doesn’t rise enough to reach these levels. , creating a potential death spiral for bitcoin. The bitcoin death spiral is when too many miners stop mining as it becomes unprofitable, and there is not enough hash power to mine enough blocks for the mining difficulty to be adjusted within 2 weeks, however this is an extremely unlikely event. If other miners are forced to stop working due to the halving, the miners that have managed to stay profitable should see increased revenues as their relative share of the total hashrate has risen. When the total hashrate goes down, the mining difficulty goes down as well. For miners who continue to mine, the halving can increase profitability by weeding out competitors and increasing the likelihood of finding a block and earning a reward.

The only question is what will happen when all the coins are mined. Theoretically, if a miner confirms enough transactions, the fees generated could help make up for the missing block reward. But the size of the transaction fee will depend on the state of the network in the future.

Miners need some kind of incentive to keep their interest in Bitcoin. In addition to increasing transaction fees, as already mentioned, another way is to change the underlying code and issue more than 21 million bitcoins.

If the current limit of 21 million is not overcome, then one of the existing scenarios should occur: an increase in transaction fees and a decrease in transaction costs should be sufficient to support the process; or, at the opposite end of the spectrum, miners can form cartels to control the supply and demand of bitcoin, as is practiced in the oil and diamond industries.

Retail Investors and HODLers

As bitcoin mining approaches its limit, the value of bitcoin is expected to rise. Assuming bitcoin remains popular, the limited supply and investment value will entice people to use bitcoin as an investment commodity that acts as a store of value rather than for transactional use.

The Bitcoin price chart speaks in favor of this extrapolation, as the price of Bitcoin is constantly rising despite the decline in the block reward. HODL users and retail investors will accumulate bitcoins in their wallets instead of issuing them. These actions will further reduce the supply and keep the price of Bitcoin high.

In the future, when a new crisis arises, central banks around the world are likely to print more money to deal with it, causing the currency to devalue. Citizens of this country may choose to use their highly inflating local currency to buy Bitcoin, a disinflationary digital currency that cannot be controlled, as a store of value, regardless of the supply of Bitcoin as long as it remains fixed.

Institutional investors

An increasing number of companies are looking to try out cryptocurrencies. Already, Tesla, Square, Morgan Stanley and many other brands have long-term plans to implement cryptocurrencies. Even Goldman Sachs is considering buying cryptocurrencies. If the popularity of cryptocurrencies continues unabated, interest in them is likely to attract more institutional investors who will be ready to take advantage of the first person advantage.

According to Philip Gradwell, chief economist at Chainalysis, institutional investors view bitcoin as digital gold. With the mining cap, scarcity, and potential rise in the price of bitcoin, institutional investors will use the virtual currency as a hedge against inflation, just as they have used precious metals in the past.

Governments

Bitcoin and other cryptocurrencies have proven to be a double-edged sword for governments around the world. While many countries do not accept bitcoin as legal tender, they are closely monitoring bitcoin's impact on the global economy. For now, El Salvador is the first country to legally accept bitcoin, but it is likely that more countries will become more bitcoin friendly or follow suit completely and legally accept bitcoin.

Instead of a “take it or not it” approach, politicians will likely prefer to find a middle ground, such as endorsing a bitcoin ETF. Governments will accept Bitcoin – but they will try to regulate every aspect of it. Instead of waiting for an answer to the question of what will happen when all bitcoins are mined, there is a strong possibility that governments of individual countries, including the United States, will create their own versions of digital currencies to compete with bitcoin, also known as CBDC, or central bank digital currency.

Сonclusion

Given the popularity of bitcoin, it is safe to assume that the future of bitcoin will continue to attract stakeholders even after reaching the total supply of bitcoin. Reaching the maximum number of bitcoins will not lead to a doomsday scenario unless bitcoin loses its demand and popularity. In a likely scenario, the bitcoin ecosystem will continue to adapt to the changing patterns of the global economy, which will provide it with a stable future prospects.