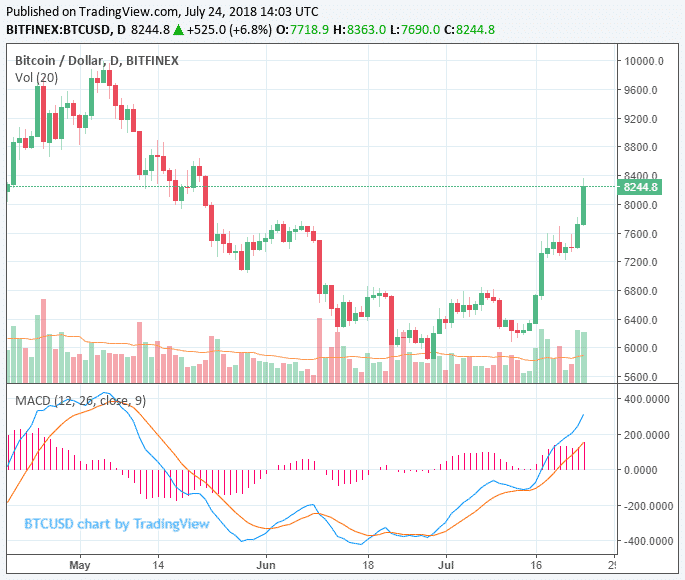

The price of Bitcoin over the last 12 hours rose to $ 8 200, exceeding $ 8 300 on the daily peak, which led to a market capitalization of $ 300 billion.

Bitcoin Cash, Ethereum, Ripple, EOS and Stellar increased by 2-6%, while some cryptocurrencies, such as Zcash, recorded an 11-% increase in value.

Drop Tokens

Since 2017, tokens have followed the price trend of major digital assets, including Bitcoin and Ether, with heightened up and down movements. If the price of Bitcoin increased, the cost of tokens increased by more than 10-20%. If Bitcoin fell, tokens fell with a higher mark.

However, over the past 48 hours, the cryptocurrency market has shown no correlation between the main digital assets and tokens, which means that investors have redistributed funds stored in small tokens to the main cryptocurrency pairs.

The volume of Bitcoin and Ether, which ranged around $ 3,5 billion and $ 1,3 billion, almost doubled over seven days to $ 6,6 billion and $ 2,1 billion. Meanwhile, the volume of even small cryptocurrencies, which appeared especially well against Bitcoin and the US dollar during the 2018 year, fell sharply over the last week.

Independent price movements in the cryptocurrency market are crucial for the next major rally of Bitcoin and other large coins, in particular, because it means the maturity and stability of the cryptocurrency market.

Under normal conditions, tokens such as Augur, Aion, TenX, Ark and Polymath would increase by at least 20-30% after increasing the price of BTC in the area from 5 to 10%. However, on July 24, the price of most tokens has actually decreased by more than 10%, which the market has not seen since the beginning of 2017.

The excess of the resistance level in $ 8000 is positive for the medium-term trend of Bitcoin, and the pullback after reaching $ 8 300 was also optimistic, as it showed an upward movement of the balance. But in order for Bitcoin to watch major moves above the $ 10 000 and $ 12 000 resistance levels, he will need to demonstrate stability and properly decline in the $ 6000 to $ 8000 area.

Before the bullish rally of 2017, during which the price of BTC increased from $ 1000 to $ 19000, BTC recorded several weeks of stability, with limited volatility and misses.

Where is the market going?

The following main levels of resistance may be $ 8300 and $ 8500, and a gap above $ 8300 may cause the Bitcoin price to enter the region at $ 9 000 in the short term.

Recognizing the strong dynamics of Bitcoin, exchanges such as Binance began to watch aggressive growth in fast-growing markets. This week, Binance demonstrated an intention to start its operations in South Korea, focusing on one of the fastest growing cryptobirds markets internationally.

As the volume of daily trading in large digital assets improves and exchanges see demand in volume, it is possible that institutional investors will potentially be able to enter the market in the coming months.