- 1. PoS Staking

- Which blockchains support DPoS and delegated staking?

- 2. Profitable farming

- 3. Liquidity mining

- 4. Crypto lending

- decentralized lending

- 5. Crypto savings accounts

- 6. Cloud mining

- 7. Dividend tokens

- 8. Affiliate programs and referral programs for cryptocurrencies

- 9. Airdrops

- Benefits of earning passive income from cryptocurrencies

- Disadvantages of earning passive income from cryptocurrencies

- Final thoughts

Passive income is obtained from activities in which a person does not need to actively participate. One common example is the rental of real estate. Another example, HODLing (“hold on for dear life”), is widespread when people buy cryptocurrencies they believe in and wait for their price to rise. However, given the volatility of the market, HODLing can hardly be considered a passive income, since the cryptocurrency can constantly decrease in price.

What are some of the ways to generate passive income while maximizing profits from participating in the cryptocurrency market in the current environment?

Let's take a look at the top 10 passive income crypto strategies.

Main conclusions:

- Maximize your profits by using various strategies to earn cryptocurrencies passive income.

- The top 10 crypto passive income strategies in 2023 include PoS-stacking, income deposits, liquid Mining, loans and other

1. PoS Staking

Staking is a term that usually means locking your funds on a Proof of Stake (PoS) blockchain platform to validate blocks of transactions. In exchange for you placing a stake, the PoS blockchain pays you a reward in its native cryptocurrency.

Staking is one of the easiest and most popular ways to earn passive cryptocurrency income. By placing a bet, you not only earn passive income, but also help protect the network from spam and malicious threats.

In many PoS chains, it is not necessary to run a full-fledged validator node to participate in staking. On chains using the Delegated Proof of Stake (DPoS) consensus mechanism, any node can use its cryptocurrency to delegate its stake rights to a full validator of its choice through transparent voting and stake allocation.

Your delegated full validator node will process blocks of transactions and share the staking reward with you based on your share of the contribution. Delegated mode is a very affordable way for almost any cryptocurrency user to earn passive income from staking.

Which blockchains support DPoS and delegated staking?

Blockchains using DPoS include Tron (TRX) and EOS.IO (EOS).

Delegated staking is not supported on some blockchains. Direct staking on these platforms is only possible if you create a full-fledged validator node, and the minimum amount you have to stake is often significant. For example, Ethereum requires a minimum commitment of 32 ETH (around $60 as of April 000, 12) to create a full validator node.

However, depending on the particular chain, there may be service providers that will help you participate in staking even on platforms without the possibility of delegation. Decentralized applications (DApps) such as Lido (LDO) and Rocket Pool (RPL) offer Ethereum staking services without the burdensome requirement of running a full on-chain validator node. These providers allow you to participate in Ethereum staking starting from the minimum amounts, and even allow you to maintain capital efficiency through access to liquid staking derivatives (LSD) so that you can continue to participate in decentralized financial markets (DeFi).

2. Profitable farming

Yield farming is the practice of depositing your cryptocurrencies into yield-generating pools on DeFi platforms to earn interest. This is a popular way to earn passive crypto income. However, given the wide variety of DeFi protocols and pools, it may require more scrutiny and active fund management compared to staking, as returns on such protocols tend to fluctuate based on the number of participants. Therefore, sometimes it may not be too beneficial for yield farmers (persons involved in yield farming).

Sometimes income farming may require users to be more involved in choosing the protocols they want to run. Alternatively, users can participate in liquidity pools managed by various yield protocols. They are known as yield aggregators, automatically investing user deposits in various revenue-generating DeFi sources. Aggregators relieve users of the need to actively move and distribute their funds between different profitability protocols, while maintaining the ability to receive interest for investing funds. Examples of such yield aggregators are the Yearn Finance (YFI), Convex Finance (CVX), and Beefy Finance (BIFI) protocols.

3. Liquidity mining

Another popular form of cryptocurrency passive income is liquidity mining, in which users provide liquidity to cryptocurrency swap pools on the DEX. Once liquidity is provided, users are referred to as Liquidity Providers (LPs) and receive an LP token, typically a synthetic asset that can be reinvested in other platforms for even greater returns.

Users involved in liquidity mining deposit their cryptocurrencies into pools, which are a pair of cryptocurrencies (for example, ETH/DAI). These pools allow users to exchange their cryptocurrencies.

In most cases, to become an LP, you deposit an equal amount of both cryptocurrencies (for example, $1000 ETH and $1000 DAI), which in turn helps maintain adequate liquidity for automated market makers (AMM) DEXs.

When there is higher liquidity on the exchange, AMM DEX users can receive their chosen cryptocurrency at more favorable rates. In order to reward LPs for this, a portion of the swap fee paid by users is rewarded to LP, which is distributed based on the share of pool funds contributed by each LP.

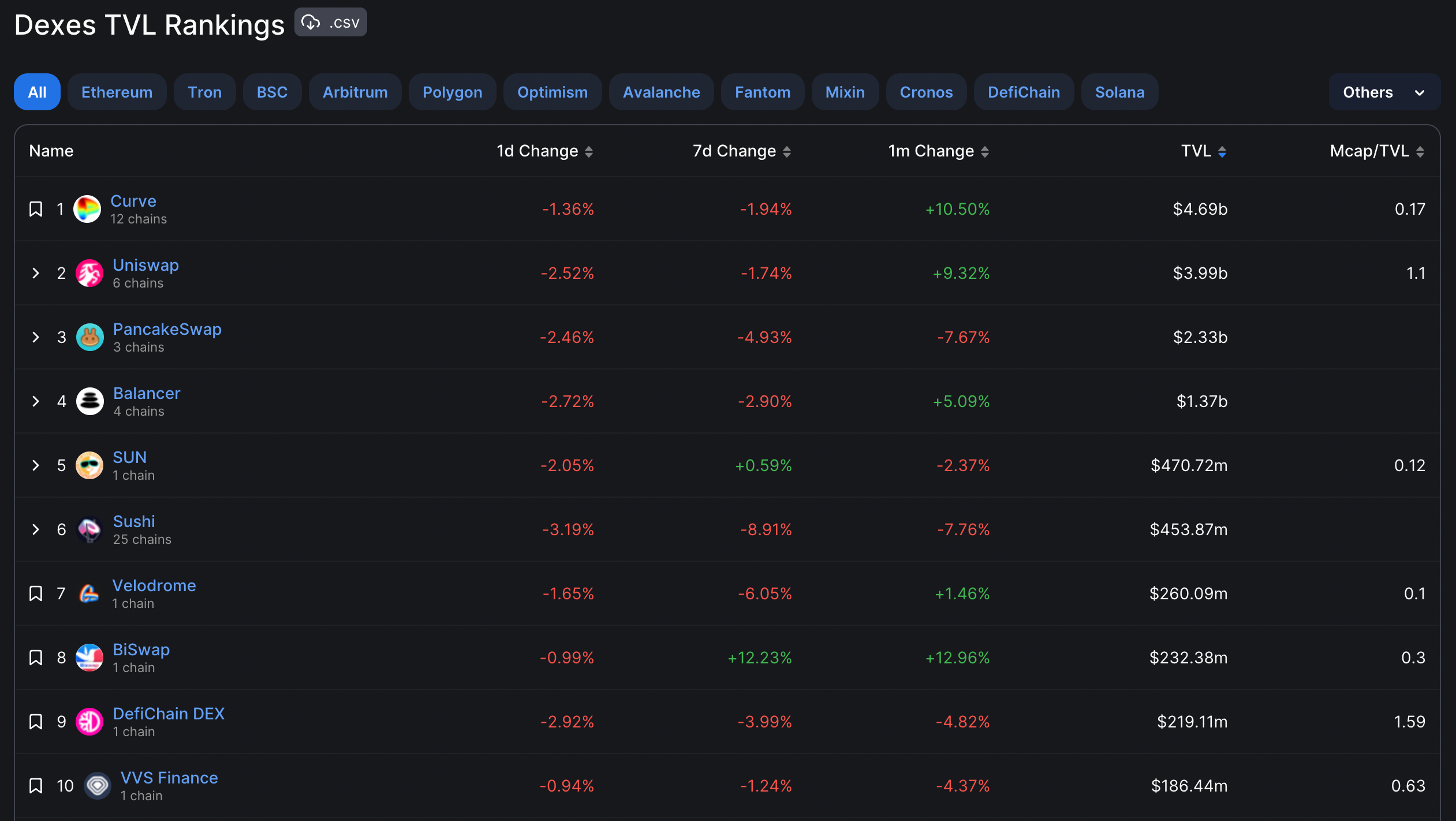

The largest AMM DEX that helped popularize the liquidity pool model (and also one of the oldest) is Uniswap (UNI). Other notable platforms where you can earn passive income from swap pools include Curve (CRV), PancakeSwap (CAKE), Balancer (BAL), and SushiSwap (SUSHI). One of the most notable DEXs to capture market attention in 2022 has been GMX on Arbitrum, whose TVL has skyrocketed both due to its innovation and the growing market on Arbitrum.

Below is a chart of the top 10 DEXs by Total Lock Value (TVL) as of April 12, 2023.

4. Crypto lending

Crypto lending - Another popular destination for users who want to receive passive income. You simply enter your cryptocurrencies into protocols for lending to borrowers. In return, you receive a reward in the form of interest. The two main types of protocols that lenders can interact with are decentralized lending and real asset lending (RWA).

decentralized lending

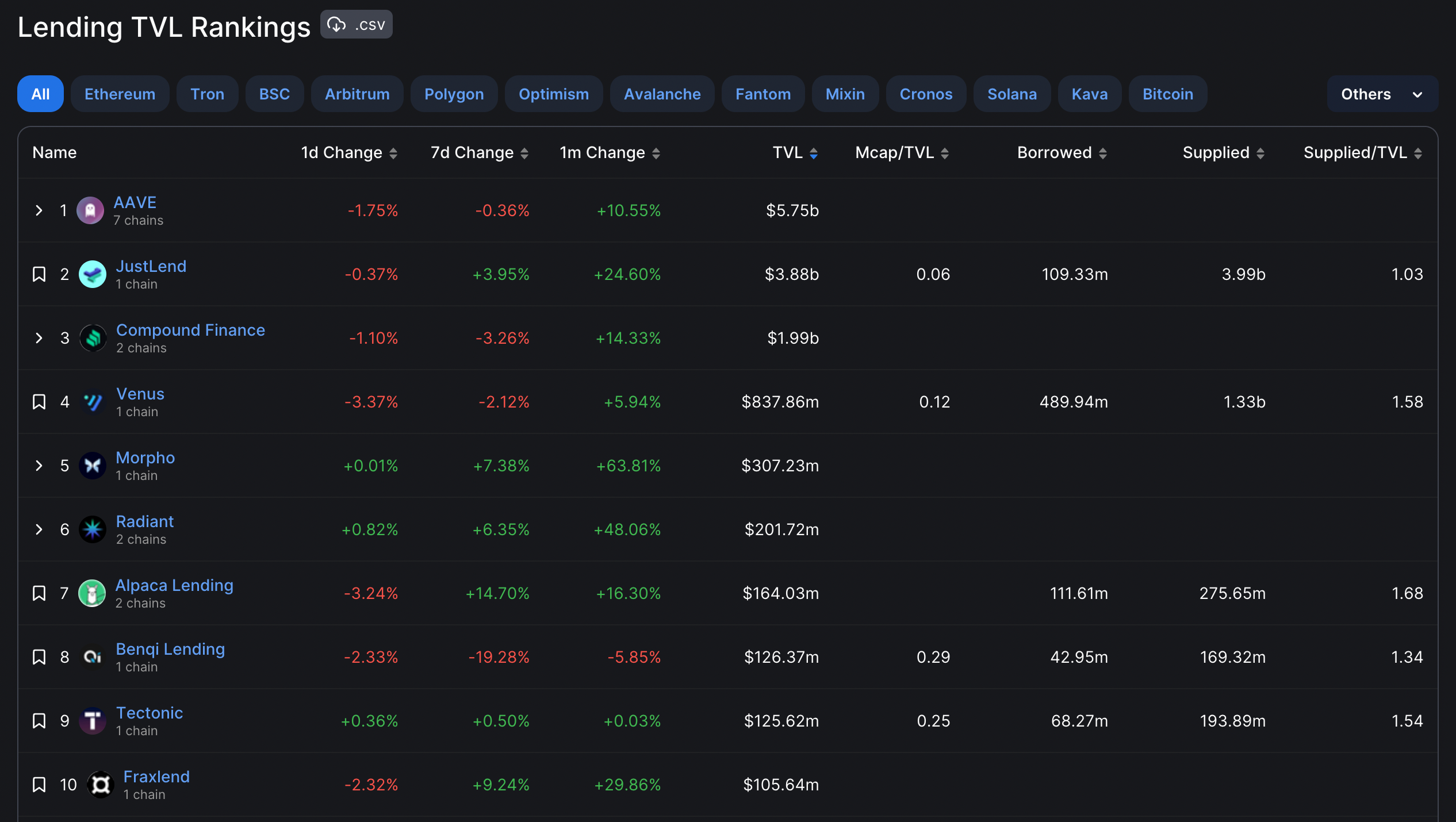

Let's start with the most common pool type: Decentralized lending and borrowing protocols. You contribute your funds to these pools as a protocol lender and earn interest on your investment. The leading protocols in this niche are Aave (AAVE), JustLend (JST) and Compound (COMP). There are also lending protocols on other chains, including Solend (SOL) on Solana and Mars Protocol (MARS) on Cosmos.

Below are 10 TVL lending and borrowing platforms as of April 12, 2023.

Most well-known decentralized lending platforms algorithmically maintain sufficient liquidity on their platforms based on the amounts issued and borrowed and the collateral provided for the borrowed funds. With proper transparency, this ensures that the funds that users have lent to the protocol are safe and that the decentralized lender always has enough liquidity to meet its lending obligations.

Real Asset Lending (RWA)

Users can also choose the RWA lending protocol, where their deposits will be borrowed by real cash flow generating businesses. These businesses are typically whitelisted by a group of auditors to ensure they are reliable before they can qualify as borrowers. In this way, lenders receive more guarantees as the risk of default is reduced by such checks. Likewise, lenders are rewarded in the form of an interest fee.

Notable protocols in this vertical are Goldfinch (GFI), Maple Finance (MPL), and Centrifuge (CFG).

5. Crypto savings accounts

Some CEXs and other financial crypto services platforms offer interest-bearing crypto accounts that are quite similar to standard interest-bearing fiat bank accounts. Basically, the crypto funds you deposit into the account will be used by the platform for lending, betting, or investing, and the profits generated will be paid out to you in the form of interest.

6. Cloud mining

Cryptocurrency mining on blockchain platforms is a great way to earn crypto income. However, typical mining requires the purchase of expensive equipment for profitable cryptocurrency mining. Cloud mining allows you to participate in cryptocurrency mining without the need to purchase such equipment. This removes the technical knowledge associated with mining and allows the wider market to participate in it, earning passive income.

With cloud mining, you pay a regular monthly or yearly fee to a service provider for the opportunity to “rent” their resources for mining. In exchange for this fee, the service provider mines the cryptocurrency using the resources you rent and pays you a portion of the mining reward. One of the most popular cloud mining service providers is Genesis Mining.

7. Dividend tokens

Dividend-earning tokens are cryptocurrencies in which some regular dividend rewards for their holders are built into the functional mechanism of the token. For example, the largest dividend-paying cryptocurrency by market capitalization, VeChain (VET), generates dividends in the form of another token on its sister platform, Thor (VTHO). The more VET you hold, the more rewards you get from VTHO.

Another example is KuCoin Shares (KCS), whose holders receive a share of the transaction fees earned by the KuCoin exchange. The distribution is proportional to the number of KCS users have.

8. Affiliate programs and referral programs for cryptocurrencies

Affiliate programs have been an important part of companies' marketing strategies for decades and have received a significant boost with the advent of the Internet. Now, a lot of websites and crypto platforms have adopted the crypto-based affiliate marketing model. By referring users to these sites and platforms, you can earn crypto income.

If you run a blog with a lot of repeat visitors or are a social media influencer in your niche, cryptocurrency affiliate programs can be a great way for you to generate passive income. Some of the most popular cryptocurrency affiliate programs in the industry offer bybit, Paxful и Coinledger.

Other protocols have also launched their referral programs allowing users to earn discounts, discounts and rewards. An example is bybit, GMX (spot and perpetual DEX) and Transaction (on-ramp protocol).

9. Airdrops

An ethereum drop is the distribution of a protocol’s native cryptocurrency among its community. A prime example is the recent Arbitrum (ARB) promotion, during which the ARB token was distributed to users who interacted with the Arbitrum network (including the creation of bridges and DApps based on Arbitrum).

By simply following a few steps, users can qualify to participate in airdropAirdrop is a type of marketing strategy that involves sending multiple tokens or coins to crypto wallet addresses in exchange for completing small tasks, such as posting a message on social media. This is usually done to raise awareness.... To keep track of upcoming promotions, use resources such as Airdrops.io и Airdrop Alert.

Benefits of earning passive income from cryptocurrencies

The above opportunities are a great way to generate passive income for a cryptocurrency investor. The main benefits include:

- A laid-back approach to wealth creation. These features, when used correctly, can help you grow your crypto wealth mostly on auto-pilot, with minimal time investment. At the very least, they should take significantly less time than any form of active trading.

- Reducing Risks During Bear Markets: Passive income from cryptocurrencies is a great way to offset the losses that many investors take during market downturns.

- An opportunity to invest in the future stars of the crypto world. By exploring and distributing your funds among various streams of passive income, you have a great chance to notice new promising projects. Unlike established coins, these future crypto stars have the potential to generate significant investment returns.

- Diversification of income streams: As you may have guessed, there is a huge variety of passive income opportunities from cryptocurrencies. Most savvy investors spread their funds across multiple streams, which will (at least indirectly) result in portfolio diversification, a useful strategy that is so often overlooked by many investors.

Disadvantages of earning passive income from cryptocurrencies

Apart from the benefits of earning passive cryptocurrency income, it also comes with some risks and disadvantages. These include:

- Risk of fraud and deceit. As with everything related to the world of cryptocurrencies, investors looking for passive income in this area should beware of unscrupulous operators engaged in fraud and tug of war.

- Risk of failure and liquidation of projects. The current downturn in the market has already claimed a lot of cryptocurrency scalps: projects are becoming insolvent and unable to return their clients' funds. Two notable recent examples are crypto lending operator Celsius Network and crypto hedge fund Three Arrows Capital (3AC). Both companies were forced to curtail their activities, failing to fulfill their credit obligations to customers.

- Rapid pace of change in the industry. The investment landscape in the world of cryptocurrencies changes frequently. New coins are emerging, interest rates fluctuate wildly, and the performance of existing coins can make wild reversals. Some investors find it difficult to keep up with the pace of change. Accordingly, in the world of cryptocurrencies, even passive opportunities are not as passive as in traditional finance.

Final thoughts

The benefits of passive income from cryptocurrencies are clear, especially in the current bear market. In fact, even those who prefer to actively participate in cryptocurrency trading would do well to try to channel some of their capital into passive sources of income.

However, while carefully considering any potential opportunity, research the market and the specific platforms you are considering. The non-trivial number of scams and project liquidations makes this check an important aspect of your overall strategy for passively investing in cryptocurrencies.