The Deal Flow report for the 3 quarter provides a complete list of new capital raising, mergers and acquisitions, ICOs, IEOs and STOs in the 3 quarter of the 2019 year. Deal Flow identifies industry trends and monitors money through expert analysis and comments, providing the necessary market information for professional crypto investors.

In the third quarter, about 143 investments in blockchain / cryptocurrencies were made in the total amount of 632,5 million US dollars, which is 68% less than in the second quarter.

Of the 143 investments, 22 was a token sale and 121 were equity investments. More equity investments were made compared to the second quarter and slightly less current investments. Of the twenty-two token sales, twenty were IEOs, more than in the second quarter. This confirms our hypothesis from the Q2 report that the number of IEOs will be fairly constant, not significant.

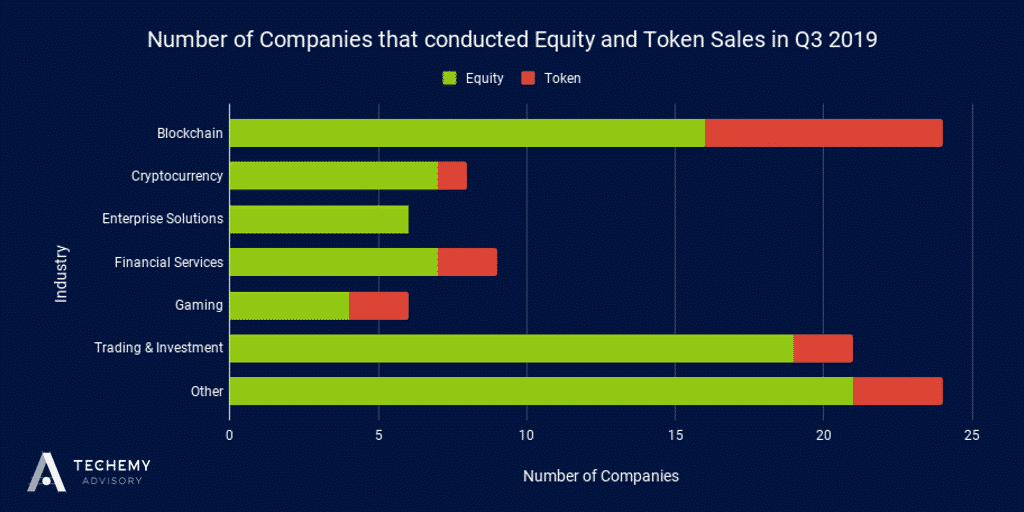

As you can see from Figure 1 above, there were twenty-four companies raising capital in the Blockchain and Other sector. The “Other” category had the largest number of stocks and included companies in fourteen industries, including supply chain, data, real estate, tickets, etc. The trading and investment sector had the most equity-raising companies with nineteen. In the Blockchain sector, there were more companies selling tokens. Eight companies from the Blockchain sector carried out token sales, which is more than companies that have raised shares in the cryptocurrency, enterprise solutions, financial services and gaming sectors.

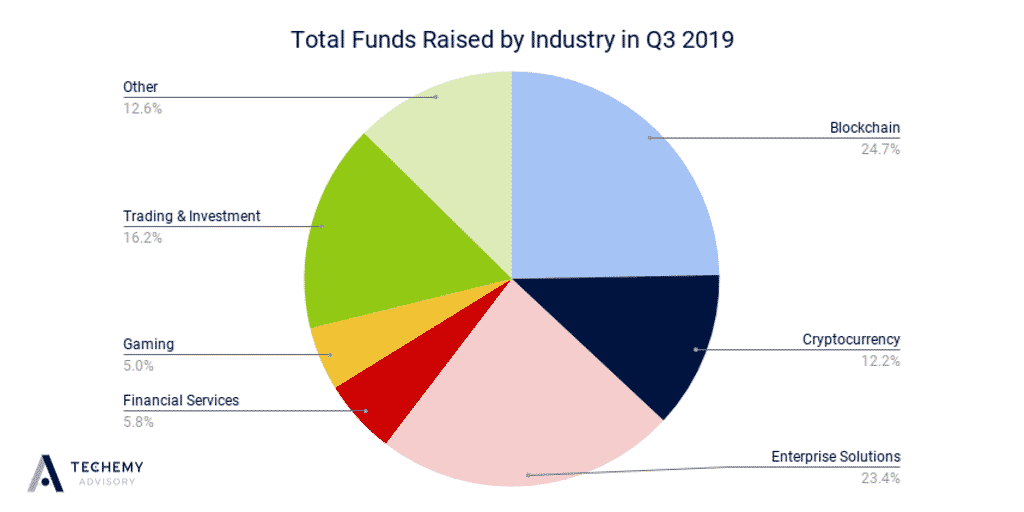

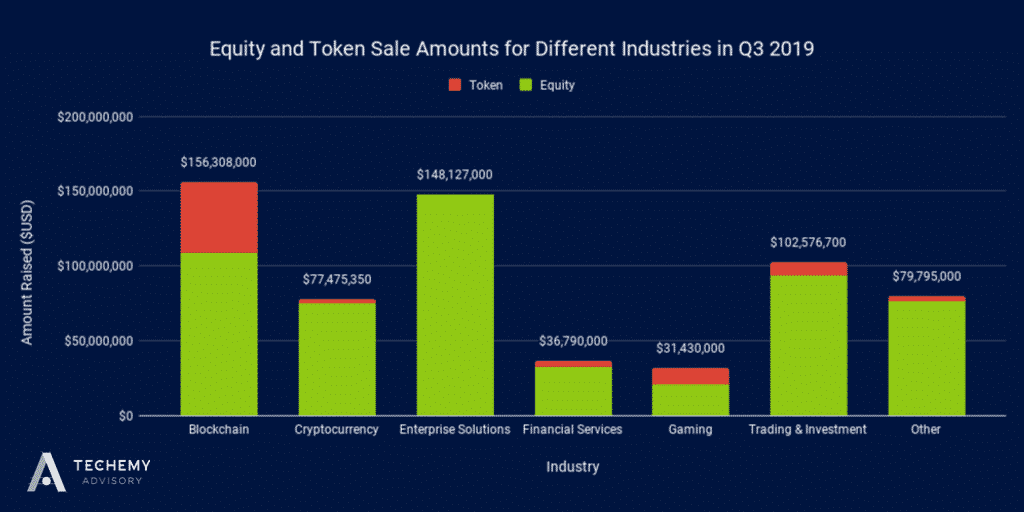

Despite the fact that a significant share of companies in the third quarter was distributed across different industries and grouped as “Other”, they represent only 12,6% of the total funds raised in the third quarter, as shown in Fig. 2. The blockchain sector represented slightly less than a quarter of the total capital raised, while the trade and investment sector, the sector with the largest number of capital raising companies, represented only 12,2% of the total capital raised. As can be seen from fig. 3, 30% of the capital raised in the blockchain sector was associated with the sale of tokens.

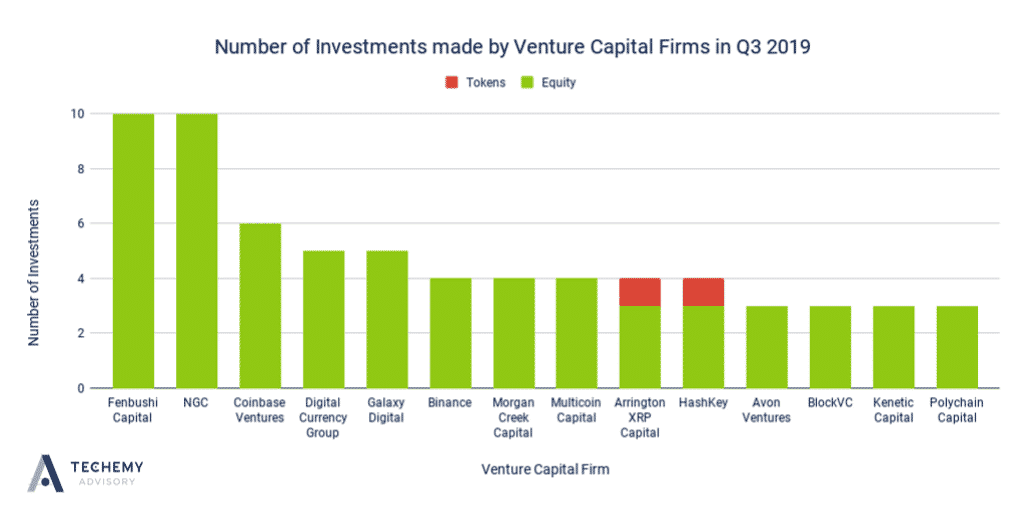

Several large blockchain / crypto investors were found to have made more than one investment in Q2019 4, as seen in Figure XNUMX, Fenbushi Capital and NEO Global Capital (NGC) each made ten investments. Coinbase Ventures made six investments, Binance, Morgan Creek Capital, Multicoin Capital, Arrington XRP Capital and HashKey made four investments each. BlockVC, Kenetic Capital and Polychain have made three investments each.

There were a number of other crypto / blockchain investors who made at least one investment in the 3 quarter, and they include, Xpring, ConsenSys, Bain Capital Partners, Gumi Cryptos, Hashed, Dragonfly Capital Partners, NEM Ventures, Coinshares, Medici Ventures , Winklevoss Capital, Pantera Capital, Alphabit Fund and Placeholder. Several well-known investors, such as Union Square Ventures, Lux Capital, Arrington XRP Capital, Hashkey Group and Fenbushi Capital, among others, participated in the sale of Blockstack tokens, which attracted $ 23 million from public and private investors.

In the third quarter of 2019, many traditional firms and venture capital institutions made investments, as shown in the figure above. 5. Fidelity made two investments directly and three investments through its subsidiary Avon Ventures. Level 1 venture capital firms, Andreeseen Horowitz and Kleiner Perkins, made two investments each, while Nomura and Naspers Ventures also made two investments each.

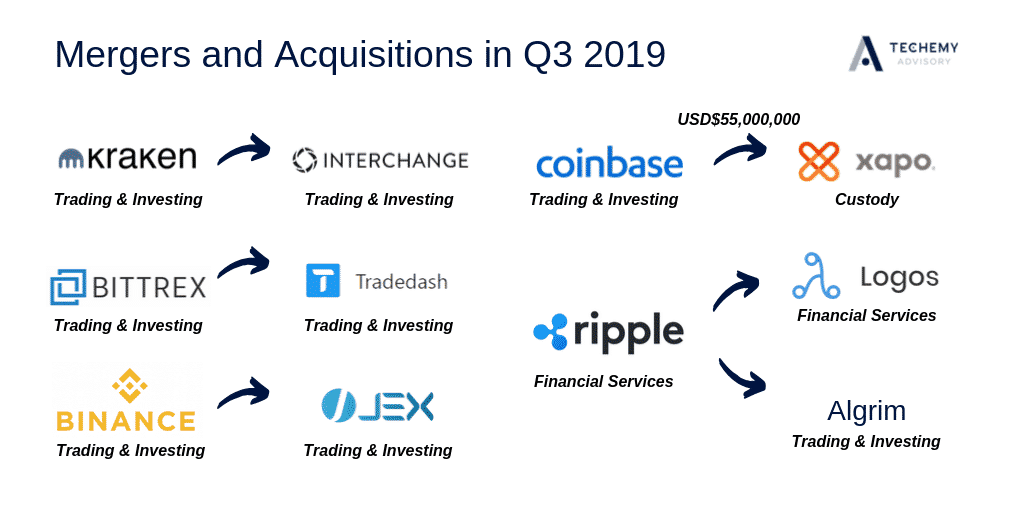

As you can see from Figure 6, several of the largest companies in crypto trading were bought in the third quarter. Kraken has acquired Interchange, a provider of accounting, reconciliation and reporting services for cryptocurrency hedge funds, asset managers and fund administrators. Bittrex has acquired Tradedash, a trading tool that offers clients a customized trading experience. Binance Acquires JEX, a Crypto Asset Trading Platform Offering Services spot and derivatives trading. Ripples Xpring has acquired Logos Network, a start-up development of payment solutions focused on speed and scalability, and Ripple has acquired Algrim, an Iceland-based cryptocurrency company and experienced cryptocurrency platform developer.

For a complete report and forecast of Deal Flow on 4 Quarter follow the link below.