How do you rate the “true” value Bitcoin ? Or better yet, how do you predict how much it will cost in the next big peak?

Unlike stock pricing models, there is no company, no income statement, no price-to-earnings ratio. There is also no balance. There is no asset valuation model.

However, some people have come up with scoring formulas. They are all hotly debated.

For example, the Chris Berniske bases its assessment on the model of the "equation of exchange".

Kyle Samani seeks to make an analysis based on the “market share capture” model.

Valiant attempts! The problem is that both rely on slippery assumptions like the speed of money.

In the midst of this controversial polemic, I was particularly intrigued by the assessment model "Stock-to-Flow (S2F)", proposed "PlanB", a quantum cryptanalyst.

This is one of the most specific – and accurate – crypto valuation models I have seen so far. Everything is based on actual measurable factors that reflect the deficit.

What is stock-to-flow?

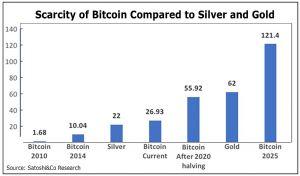

Quite simply, it is the current circulating supply divided by the annual production. And it can work for almost any product.

Take gold, for example. In the above chart, gold has a Stock-to-Flow (S2F) value of 62.

That is, based on today's production rates, it will take 62 of the year to reproduce the current supply of mined gold in the world.

This is relatively small. In fact, based on this figure, gold is almost three times less likely than silver, which has a current S2F of just 22.

Now, guess what is the ratio of reserves to the flow of Bitcoin?

Answer: almost 27.

Right. Based strictly on this measure and keeping all other factors in mind, it will take 27 years to replicate the current Bitcoin supply.

Is this scarcity metric similar to silver? Yes ... bye. But ...

Roughly every four years, the Bitcoin protocol requires a major change called “halving,” a 50% reduction in the block reward that miners receive for creating a new Bitcoin block. And the next halving event is expected around May 2020.

Currently, BTC is produced at a rate of 12,5 BTC (i.e. Block Reward) every 10 minutes. From May 2020, the reward for this block will be halved to 6.25 BTC.

And I repeat again: This is a halving according to the Bitcoin protocol. This should happen approximately every four years.

How does bitcoin halving fit into the Stock-to-Flow model?

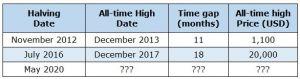

The table above provides some answers. It tracks and predicts the price of Bitcoin based on a Stock-to-Flow pattern and periodic halving.

Basically, this is how it works ...

First, the the blue line shows the Bitcoin price predicted by the Stock-to-Flow model.

Second, the the red dotted line shows the actual prices for bitcoins to date.

Third, we ask an important question: how well does it work? The answer ...

The model corresponds to real prices in the amount of 95%

Naturally, in the real world, there are periodic bursts accompanied by sharp pullbacks. But overall, Bitcoin prices follow the Stock-to-Flow ladder very well.

One way to measure accuracy is a statistical metric called R2, which measures how closely the data fits the model. And in this case R2 is 95%. Very good match.

Another key to model accuracy: The stair model forecast (blue line) can be converted to a smooth curve (gray line). Over time, this curve turned out to be the support line for Bitcoin's price.

In other words, when the bitcoin market falls, it tends to lower near or on this line!

The third argument in favor of the validity of the model is the actual impact of past halvings on the price of Bitcoin, as shown in the table below…

When will Bitcoin reach its next high? And how much will it cost?

Unfortunately, Bitcoin is too young to answer any such question with certainty. We barely have a decade of trading history. And data from the beginning of the decade when Bitcoin trading was illiquid is not very reliable.

However, given this warning, it is reasonable to set some expectations as follows:

First, we know that the next halving will happen around May next year. Thus, based on the data in 2012 and 2016, the time for the next Bitcoin high should be in about one to two years - as early as May 2021 or May 2022.

Then we come to the most important number of all: the most probable price of bitcoin at this next maximum.

No one can predict what surprises the future might bring. But after the reward has halved by 2020, the model predicts the value of bitcoins between $ 50 and $ 000.

Moreover, we know that in all past historical highs, the actual peak in a short time exceeded the predicted maximum of the model.

What happens if Bitcoin hits these target prices? The corresponding market caps for Bitcoin of $ 50 and $ 000 are approximately $ 100 billion and $ 000 trillion, respectively.

Sounds like a pipe dream? Well then, consider that $ 1,8 trillion is actually little compared to the total 7 trillion US dollars in market capitalization of gold .

Just remember one thing: the next halving will not happen until May 2020. So there is still time to accumulate bitcoins and other highly rated currencies before the powerful forces of this model take effect.

Is Bitcoin Interesting? read on!