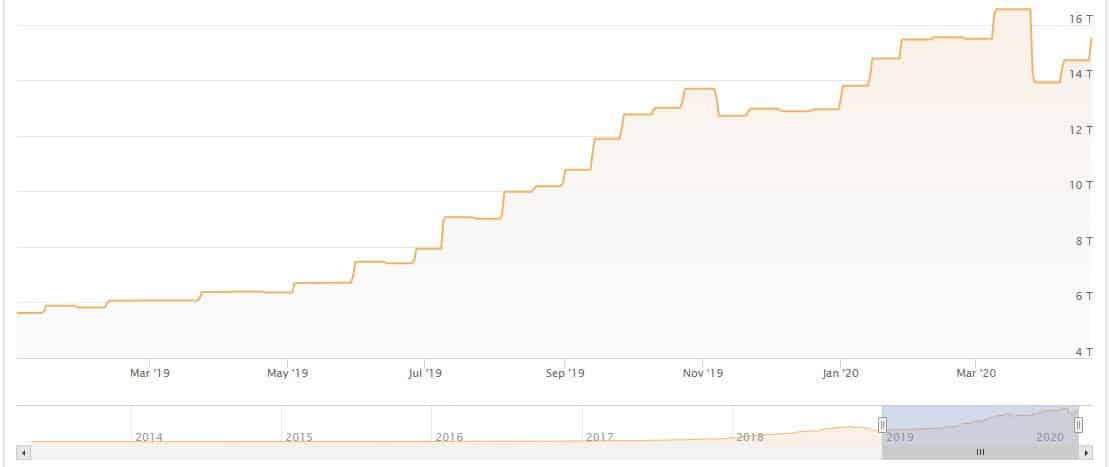

Currently, the price of bitcoin may remain the same, but the bitcoin network is as strong as before. The complexity of the network has grown to almost a historic high with a record positive adjustment of 8,5%

On the other hand, network hashing speed is also increasing. Last week, it rose to almost ATH 133,29 thousand / s and currently stands at 115 thousand / s. The hash rate in the network is closely related to the profit of miners.

The hash rate increases with the increase in the number of resources allocated to protect the network through mining. As these allocated resources increase over time, production costs and / or increased efficiency also increase.

All time high #bitcoin difficulty (hashrate ~ 114E18) 🚀 pic.twitter.com/mZJyLnpq8U

— PlanB (@100trillionUSD) April 21, 2020

This means that for miners, in order to maintain a healthy rate of return, it is necessary to increase the hash rate to match the rising price of assets.

According to a PlanB analyst, continued growth is also a result of the fact that new large professional mining companies in the USA begin to engage in the mining business and new 7-nm equipment

However, despite the fact that earlier this year it was announced the deployment of ASIC mining rigs, the Antminer S19 and Whatsminer M30S series, they have yet to be widely distributed among miners.

In a discussion organized by Bitcoin Magazine, Poolin Vice President Alejandro de la Torre noted that there were rumors that Chinese miners were able to acquire these rigs, but have not yet done so.

“No one can take them out of Asia… No one in Europe or the US can get these new miners, or if they can, it’s very expensive, so they probably don’t,” he said.

It is estimated that after having continues to grow, the cost of hacking will drop to $ 15, making BTC at current prices extremely unprofitable for miners.

Behavior as a Beta High Asset Beta

While hashing speed and complexity continue to rise, Bitcoin's price still fluctuates around $ 7000. However, after Black Thursday, when the price of Bitcoin fell by almost 50%, it recovered by more than 75%.

This violent sale was the result of a coronavirus pandemic and was consistent with the global stock market. Thus, the digital asset demonstrates a “strong vulnerability to fluctuations in the stock market” during both upward and downward trends.

“This behavior is the classic definition of high sentiment beta assets. In particular, when investors are bullish on stocks, they tend to overshoot against Bitcoin, and when market sentiment turns into Bitcoin bearish positions, they are quickly liquidated,” – сказал Jesus Rodriguez, CTO of IntoTheBlock.

Bitcoin, acting like a high-profile beta asset, makes sense for an emerging and highly speculative instrument, he said.

During this time, the average transaction feesmeasured in bitcoins in dollars have grown by about five times. The violent sell-off immediately impacted commissions as traders rushed to transfer coins to and from exchanges in order to increase profits on profit positions from arbitrage opportunities.

Although the most direct influence of Black Thursday has now disappeared, a month after the event with a decrease in volatility and tightening spreads, "some long-term effects are only beginning to appear," Coin Metrics noted.

The futures market is currently undergoing reshuffle, as BitMEX is losing part of its market share in Binance.