Staking and Proof of stake projects such as Ethereum 2.0 и Polkadotwill reward you with cryptocurrency for placing your coins. This is how it works.

While the Bitcoin network is secure mining, many new cryptocurrencies use an alternative consensus mechanism known as Proof of stake (POS).

This implies that users stake their cryptocurrency – stake their crypto assets on the network to help the blockchain validate transactions.

But staking is not just an altruistic act for the benefit of the network. In exchange for staking, you are rewarded, often in the form of the cryptocurrency you wager.

Here we explain how you can get started as a cryptocurrency staker.

What is staking?

Blockchains are basically databases of transactions with no central authority to maintain them.

To solve the problem of securely verifying transactions, PoW blockchains like Bitcoin rely on mining, powerful computers competing to solve cryptographic puzzles. But mining requires expensive equipment and high power consumption, so it is out of reach for most people.

Proof-of-stake networks such as Polkadot, Cardano, and Ethereum 2.0 are replacing it all with a disbursement mechanism known as staking.

Basically, Proof-of-stake involves choosing validators based on how much cryptocurrency they hold on their node. This cryptocurrency can be supplied by the validator itself or delegated to other users along with its node.

In the same way that miners are rewarded with cryptocurrency for the work they have done (all these expensive computations), the validator is rewarded with cryptocurrency ... when they place a bet on cryptocurrency. Anyone who delegates a cryptocurrency to a validator also receives a portion of the reward based on how much they bet (minus the validator's share, of course).

Thus, betting (staking) can be a financially attractive option for crypto investors who own assets, rather than day trading, no matter how small. The great thing about staking is that while staking can be based on complex mathematics, very little technical knowledge is actually required to stake.

What cryptocurrencies does staking work on?

According to a report by the American firm Staked "The State of Staking" in July 2021, as of the second quarter of 2021, assets worth about $ 171 billion were placed in transactions using PoS cryptocurrencies.

Here are the top five by market capitalization with average returns.

Ethereum 2.0 (ETH 2.0): 6,8%

Cardano (ADA): 4,6%

Polkadot (DOT): 14%

Solana (SOL): 7,4%

Polygon (MATIC): 14,9%

The rates of return differ on different platforms and may vary depending on the number of validators active on the network.

Did you know?

Cardano (ADA) has the highest rate of any major PoS cryptocurrency, with 71,7% of assets staked.

Staking and Staking as a Service (SaaS)

Generally speaking, there are two ways to place bets.

The first is like a validator running its own node. This method requires a small initial load. You need to have a secure and stable technical infrastructure and experience to run a validator node on your own. The minimum number of coins required to wager is also often relatively high. To become an Ethereum 2.0 validator, you need to have at least 32 ETH!

But most often, staking is done through delegation - you delegate your coins to a validator that has the appropriate setting. The validators will do the hard work of maintaining the node for you in exchange for a commission deducted from your staking rewards. Very simple!

Now there is even a whole industry called staking-as-a-service Staking as a Service (SaaS).

Some of the major SaaS companies include:

- Staked

- Figure Network

- MyContainer

- Stake capital

- Stake Fish

It is important to note that delegating coins does not mean that you are passing them on to a validator. You keep your assets at all times.

Generally, you don't need to do anything with your rewards because they are automatically reinvested. Some staking platforms allow you to opt out of this if for some reason you don't like the idea of charging rewards.

Staking through cryptocurrency exchanges

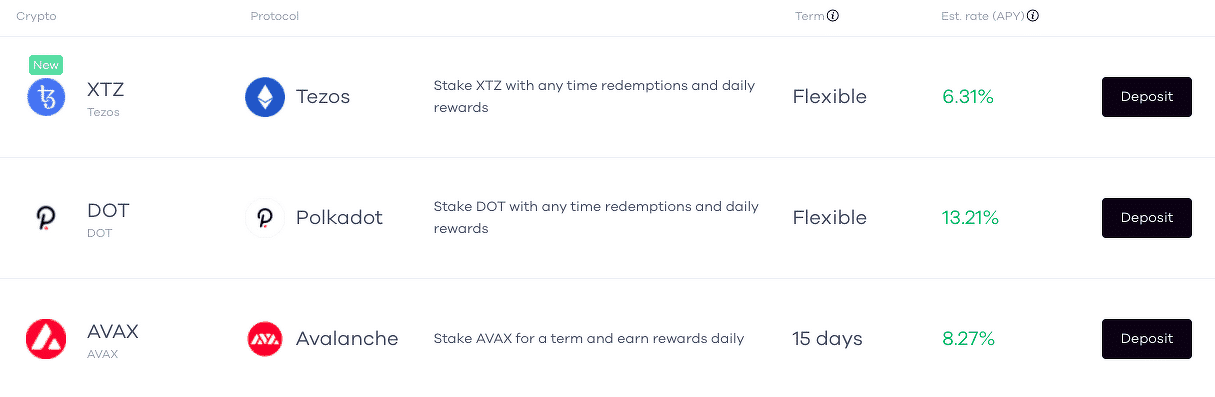

Most cryptocurrency exchanges use their own validators allowing their clients to place bets with them through the exchange's user interface. This is for example:

Binance

Coinbase

Creak

Bitfinex

OKEx

KuCoin

Okcoin

The process for placing bets on different exchanges is almost identical (explained below). But the staking offers of exchanges differ in what cryptocurrencies are available for staking, their fees and the blocking period (if any).

Some exchanges, like Kraken, place bets on their main menu, so it's easy to find them. But others, like Binance, will list it in the Earning section, which also includes other ways to generate passive cryptocurrency income, such as lending or borrowing.

Not all major exchanges allow you to place bets. Gemini "Earn" allows you to earn interest on PoW cryptocurrencies such as Dogecoin, but does not offer betting on PoS cryptocurrencies.

Popular trading app Robinhood announced in July 2021 that it may offer staking in the future.

According to regulations, exchanges may not allow you to place bets if you live in certain jurisdictions, such as New York or Hawaii.

How do I stake cryptocurrency?

Betting is a fairly simple operation that only takes a few clicks.

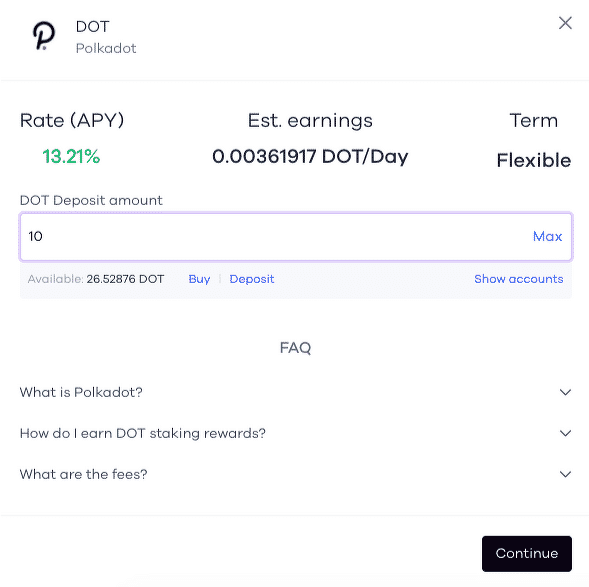

In the example below, we will show you how to stake Polkadot on Okcoin – when it comes to staking, there are more similarities than differences between the platforms, so these steps can be easily replicated on other exchanges and services.

- First, go to the "Earnings" exchange page.

- Click "Deposit" for DOT.

Then enter the amount you want to wager, or press "max" if you want to wager your entire DOT.

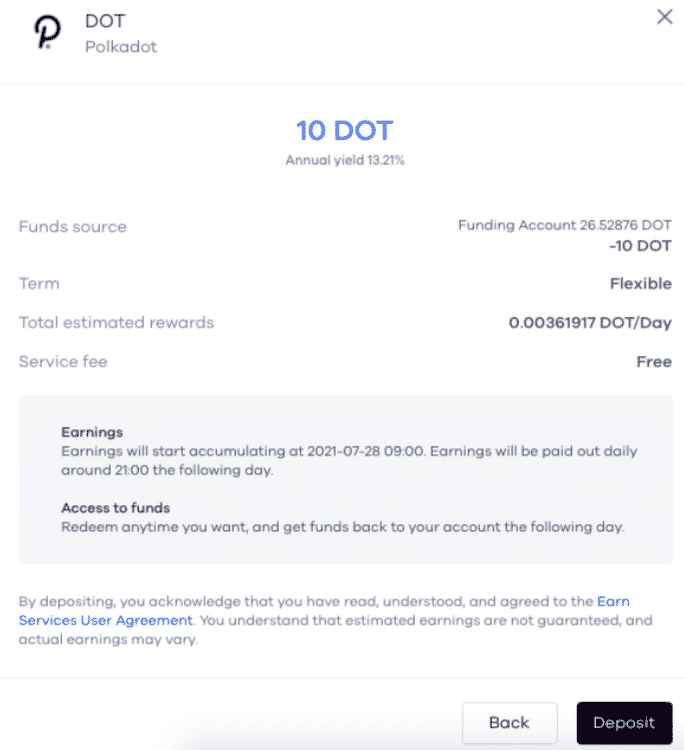

As a rule, exchanges will give you the opportunity to review the terms and conditions before making a deposit.

If everything is in order, click "Deposit" and you're done!

Now that your DOT has been placed, all you have to do is wait until the next day and your earnings will start to rise. DOT Rewards are credited to your Funding Account on a daily basis (at least in this example), and they just keep increasing until you put an end to it.

In most cases, you can stop placing bets at any time. Except for a few exceptions like Ethereum 2.0, staking does not require any stakes!

Did you know?

It is now possible to stake Ether (ETH) because the Ethereum blockchain is currently moving from PoW to PoS Ethereum 2.0. But the delivered ETH remains locked until the transition is completed on an unspecified date in the near future.

Staking and taxes

Since cryptocurrency staking is a relatively new concept, many tax authorities around the world have yet to take an official position on how to tax it. In March 2021, HMRC UK updated its tax guidelines to include a betting guide, considering it broadly in line with crypto mining.

In the meantime, the IRS issued a guide to crypto mining income in 2014, stating that mining would result in taxable gross income. Since mining is viewed as a business, mined coins are immediately taxed as regular income after they are created.

But this advice only applies to mining, not betting, and a lawsuit currently pending in Tennessee federal court casts doubt on the applicability of this position to betting. Plaintiff Joshua Jarrett argues that his Tezos betting fees should be treated as property and taxed only when they are sold or exchanged.

Others argue that because staking rewards have an established market value at the time they are created, they should be taxed as income from the time they are created. But with some tokens generated every minute or even a second, this would result in hundreds or thousands of taxable events (for example, the Cosmos blockchain creates new blocks every six to seven seconds; the reward rate would result in over five million taxable events per calendar year).

The disputes are yet to be settled, so for now, the best advice for potential participants is to find a tax advisor with experience in cryptocurrency accounting.

The future of staking

The convenience of not having to leave cryptocurrency exchanges to participate in staking has made them a popular choice for less tech-savvy cryptocurrency users or those with sufficient funds.

The projected annual betting reward based on Q12,5 data is $ 2025 billion this year, according to Staked. According to JP Morgan research, this figure will increase to $ 40 billion by XNUMX.

One reason is the general trend in cryptography towards proof of stake, fueled by criticism of proof of work for its impact on the environment. In addition, POS makes it easier to set up and scale a new network.

Staking is likely to represent a large share of the overall cryptocurrency market as Ethereum, the world's second largest cryptocurrency, moves to PoS with the Ethereum 2.0 update.

About 5% of all ETH is currently held in ETH 2.0. But Alex Svanevik, CEO of think tank Nansen, told Decrypt that we can expect a significant increase in ETH rates after the merger, with Ethereum 1.0 and Ethereum 2.0 interacting with each other. After this key development in Ethereum, investors will be able to withdraw their ETH rates, which is currently not possible and may explain why ETH rates are so low.