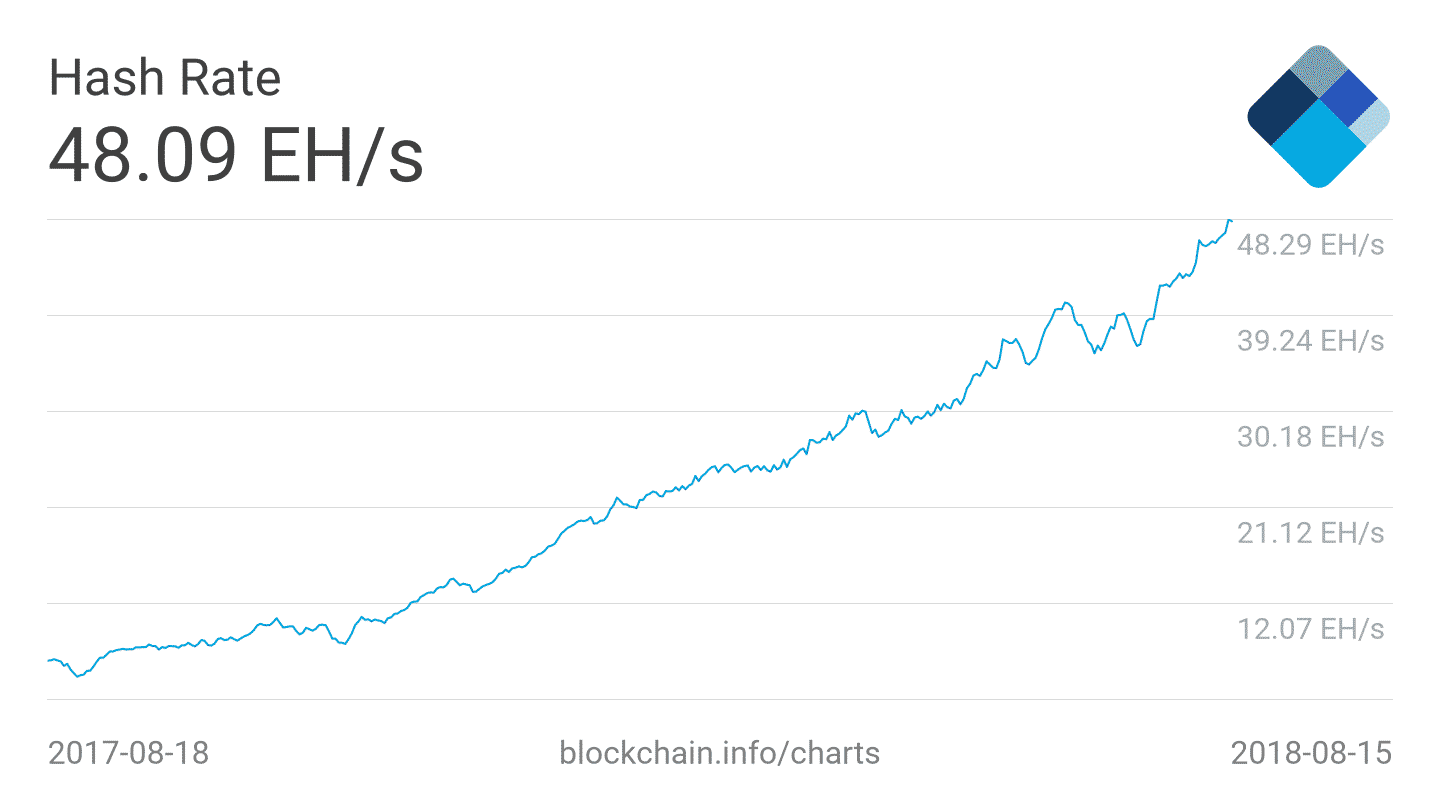

Since the beginning of 2018, Bitcoin has fallen by more than 65%, which leads to the assumption that the mining activity is suffering losses due to lower prices. However, it became obvious that this did not happen, as the hash rate in several networks constantly observed higher lows (and higher highs) among the overall market downtrend. You may ask, where is the proof?

Well, as can be seen from the following table from the Blockchain information and statistics service, the seven-day average hash rate has almost doubled since the beginning of the year, even when Bitcoin underwent serious “dives” down. This was also observed in other networks, although not that bad, because Ethereum saw a doubling in the hash rate, and the Litecoin hash rate almost tripled.

Taking into account the hashrate statistics, it can be assumed that Mining still beneficial for all parties involved. But according to a recent Bloomberg article, it might not be that easy. Over the past months, experts such as Tom Lee and Brian Kelly of Fundstrat have stated that the break even cost of mining is well above today's prices. But hashrates keep going up, up and up, as miners seem to be oblivious to overall mining fees (electricity, maintenance, hardware, etc.).

According to Marco Sil, CEO of Genesis Mining:

“There are still major extensions, especially from more efficient miners. The expansion is so large that it compensates for the rejection of inefficient miners. ”

The previous statement said that operations such as data centers, which occupy tens of thousands of square feet and consume a lot of megawatts of electricity, have grown so much that forced retail users to exit the market, exponentially.

Theoretically, as Tom Lee constantly remarks, increasing the hashrate (and the subsequent increase in mining costs) should lead to higher cryptocurrency prices, as some analysts see the break-even level as unofficial. Therefore, many believe that the opposite is true, but as the computing power and operating costs move downwards, it becomes obvious that there are other factors underlying the networks in which the number of miners grows.

David Sapper, Chief Operating Officer (COO) at Blockbid, says:

“Increasing the hash rate means that people are here for a long time, because they are happy to simply accumulate what they have, they can potentially even be at a loss. At the same time, they sometimes have to merge. ”

This causes a very interesting moment when miners working in equilibrium or with insignificant / average losses only keep their machines for the accumulation of cryptocurrency. This step suggests that, while some firms may need to sell cryptocurrency to cover costs, this long-term “HODL” approach may indicate a sense of market success in the long run.

While some data centers may operate at a loss, as noted by the aforementioned CEO of Genesis Mining, it varies from firm to firm, as specific farms are subject to many factors that lead to increased costs. Genesis Mining, having recently taken a step toward closing down unprofitable mining contracts, is still expanding its centers by buying new equipment that can keep up with hash rate growth. In addition, there are firms such as Bitmain that produce ASICs, which makes the Chinese company relatively profitable in this process.

Despite the fact that Ashiki can continue to increase capacity, energy efficiency and manufacturability, it remains to be seen whether the hash rate will grow exponentially in the future.