- What gives Bitcoin value?

- Who owns the most bitcoin?

- How many bitcoins does it take to become a billionaire?

- Who are Bitcoin Billionaires?

- Institutional investors

- State and private companies

- Government holdings

- What does it mean for institutions to own so much bitcoin?

- What happens after all bitcoins are mined?

There are many decentralized digital currencies that you can invest in, the most popular cryptocurrency at your disposal is Bitcoin (BTC). It currently has a market cap

Market capitalization (or market price) of a cryptocurrency is a measure of its market value. In other words, she...

is $ 1,15 trillion and has grown steadily since Bitcoin's creation in 2009. Like all cryptocurrencies, the value of bitcoin can vary significantly depending on numerous market factors.

Despite the volatility of Bitcoin and other types of cryptocurrencies, it is important to understand that Bitcoin is currently the most valuable cryptocurrency on the market.

In this article, we'll take a closer look at how bitcoin gets its value, who owns the most bitcoins, and how people and companies can become bitcoin billionaires.

What gives Bitcoin value?

If you are thinking about investing in bitcoin in the near future, you might be wondering what gives bitcoin its value. Bitcoin is a form of digital currency that is considered an alternative to government-issued fiat money. Since central banks control the amount of paper money printed, naturally this gives central banks more control over the economy. By comparison, Bitcoin is run by a decentralized authority on a decentralized network using blockchain technology, so it is not regularly used in retail transactions.

Although Bitcoin does not find wide application in the economy, it derives its value from many different factors. A comparison can be made between the value of gold and the value of bitcoin. Both of these products have very specific uses and are limited in quantity. Like precious metals, bitcoin is durable. However, it is more “portable” than metals such as gold, silver, or platinum, more fissile, and, in some respects, safer. BTC is even called “digital gold”.

Digital currencies like bitcoin have value because they are able to function as both a unit of exchange and a store of value. Bitcoin also has six main characteristics that allow it to be used in the economy:

- Deficit

- Acceptability

- Separability

- Durability

- Counterfeit resistant

- Portability

Since Bitcoin qualifies as a form of currency, it is able to store a certain amount of value. One of the main reasons for this is the shortage of bitcoin reserves. In fact, the maximum number of bitcoins that can be mined is just under 21 million. This level of scarcity allows for a significant increase in the value and market price of bitcoin.

Who owns the most bitcoin?

To understand who owns the most bitcoins, it is important to know how many bitcoins can be put into circulation. When bitcoin was first created in 2009, there was a hard cap on the number of bitcoins that could be circulated at nearly 21 million. Currently, the number of bitcoins in circulation is about 18,8 million. A limit has been placed on the number of bitcoins that can be created each day, which means that the remaining bitcoins will be mined at an increasingly slow pace from now until 2140 in a “halving” process.

Although there should be 18,8 million bitcoins on the market, it is estimated that around four million BTC has been lost since the digital currency first came into circulation. It is believed that Satoshi Nakamoto, the pseudonymous founder of Bitcoin, was the first to miner this currency. Nakamoto has mined over 22 blocks and received over a million bitcoins in cumulative block rewards. His (her / his) current holding is believed to be around 000 BTC, with a present value of over $ 1 at a price of $ 000 per BTC.

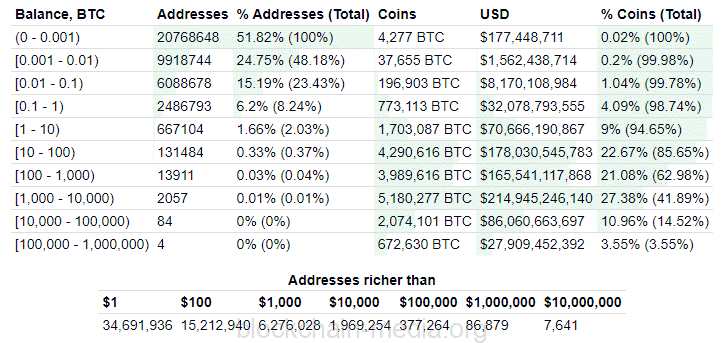

The owner of a bitcoin can be determined by looking at the addresses of bitcoins in circulation. Today there are only three separate Bitcoin addresses that hold over 100 BTC. Another 000 owners have between 83 and 10 BTC. The 000 richest addresses account for just over 100% of the total amount of bitcoins in circulation.

How many bitcoins does it take to become a billionaire?

Given that the price of bitcoin fluctuates daily and is volatile, it is difficult to determine exactly how much bitcoin a person needs to become a billionaire. However, the current value of bitcoin can be used to calculate how much to own. At a cost of one bitcoin of about $ 47, an individual or legal entity needs to own more than 000 BTC to become a billionaire.

Who are Bitcoin Billionaires?

If Satoshi Nakamoto is included, there are currently four addresses that hold enough bitcoin to be considered bitcoin billionaires. With over 1 BTC, Nakamoto – who can be either an individual or a group – owns more Bitcoin than any other entity. The four remaining billionaires are estimated to own around 000 BTC in total. Each individual address holds over 000 BTC and up to over 672 BTC. These addresses are mainly located on two cryptocurrency exchanges (Bitfinex and Binance), with the third and fourth located in an unknown location.

These addresses are:

Wallet addresses

34xp4vRoCGJym3xR7yCVPFHoCNxv4Twseo: 265 480 BTC

Bc1qgdjqv0av3q56jvd82tkdjpy7gdp9ut8tlqmgrpmv24sq90ecnvqqjwvw97: 168,010 BTC

1P5ZEDWTKTFGxQjZphgWPQUpe554WKDfHQ: 121 BTC

3LYJfcfHPXYJreMsASk2jkn69LWEYKzexb: 116 BTC

Institutional investors

There is a wide range of different organizations investing in bitcoin, including individual investors, investment firms, and government-owned companies. Some investors choose to invest their money directly in bitcoin by buying currency on a cryptocurrency exchange. However, it is also possible to invest in a portfolio that contains a wide range of Bitcoin-related assets. There are companies that invest in Bitcoin and there are even a growing number of Exchange Traded Funds (ETFs) that are investing in BTC. For example, the Grayscale Bitcoin Trust (GBTC), the largest Bitcoin ETF, holds approximately 654 BTC, or almost 600% of the total supply.

State and private companies

Although individual investors own a significant amount of bitcoin, there are also public and private companies among the proponents of this digital currency. Companies can invest in bitcoin from their corporate savings, which are commonly referred to as treasury savings. This strategy is used by companies and investment firms such as Digital Currency Group, Tesla and MicroStrategy. Some companies have chosen to invest in bitcoin and other digital assets as a way to protect them from negative yield bonds and inflation.

Currently, public companies hold over 216 BTC, which is 000% of the total bitcoin supply. More than 1,029 bitcoins are owned by ten companies. However, almost 200% of the bitcoin owned by public companies is owned by MicroStrategy. This company acquired bitcoin through a bond placement and corporate treasury. The bonds MicroStrategy has purchased have low interest rates and can be exchanged for fiat money or stocks. Tesla, meanwhile, owns nearly 000 bitcoins.

Specifically, private companies own a little over 174 BTC, which is 000% of the Bitcoin supply. The most notable private owner of this cryptocurrency is Block.one, a Chinese corporation with around 0,829 BTC.

Government holdings

Governments of various countries also own a significant amount of bitcoin. At the moment, the governments of all countries of the world collectively own about 260 BTC, which is 000% of the total supply. Bulgaria alone is believed to hold over 1,237 BTC. The US government received Bitcoin from Silk Road in 213, but ended up selling it in 000. If the US government held this currency, it would now be worth billions of dollars. However, each coin was sold for $ 2013.

What does it mean for institutions to own so much bitcoin?

In general, institutions that own a significant share of bitcoin are not a major problem in and of themselves. When institutions like Tesla invest in Bitcoin, the use of BTC becomes more mainstream. In fact, it is quite possible that more and more institutions investing in Bitcoin will eventually lead to its wider acceptance as the standard currency – with fewer restrictions.

What happens after all bitcoins are mined?

Predicting what will happen after all bitcoins are mined can be difficult due to the evolving cryptocurrency ecosystem. However, the bitcoin economy will inevitably change when all 21 million bitcoins are in circulation. For example, traders and miners will have different incentives. Instead of receiving blockchain rewards, miners will be able to generate income and profits from transaction fees... The truth is that even the largest Bitcoin owner in quantity has no control over the Bitcoin network. Therefore, it is relatively impossible to predict exactly what will happen.

Bitcoin is a very popular cryptocurrency that can be easily purchased on your preferred exchange. Although bitcoin's value is somewhat volatile, its scarcity has allowed it to reach a current value of over $47. Now that you know who owns the most bitcoins and which institutions are investing in this currency, you can move on to the next investment.