Yield enhancement is a critical component of decentralized finance (DeFi), where investors are able to lock up their tokens and earn passive income through various yield opportunities.

While the DeFi ecosystem may be saturated with a wide range of yield-enhancing products, Alpaca stands out as the first platform to offer investors enhanced yield using BNB Chain, offering them ample opportunities. The platform connects lenders and borrowers by providing secured loans, further increasing profits.

Alpaca Finance initially specialized in high-yield yield farming, but has since diversified its operations to include products such as NFTs, lending, a perpetual futures exchange, and automated vaults to reach a broader base of users in the cryptocurrency space.

Let's take a closer look at the Alpaca Finance project to understand why it is causing such a stir in the DeFi world.

Main conclusions:

- Alpaca Finance, the first managed return farming and lending protocol built on BNB Chain, is focused on improving capital efficiency for users.

- Its key products include high yield farming, lending, automated vaults, a perpetual futures exchange and NFTs known as Alpies.

- ALPACA is Alpaca Finance's governance and utility token with a deflationary mechanism to ensure its value increases over time.

What is Alpaca Finance?

alpaca finance is a new blockchain-based protocol on the BNB Chain that provides DeFi investors with a wide range of products such as high-yield farming capabilities, lending, automated vaults, perpetual futures and NFT exchanges through an efficient capital structure that maximizes returns.

The first version of Alpaca Finance, AF1.0, was launched in 2021 and was focused on the core product of high-yield farming, which allowed lenders to receive stable and secure returns and borrowers to receive loans against property.

However, in 2023, Alpaca upgraded the protocol to AF2.0, expanding its offerings to include overcollateralized lending, tiered asset lending, high-yield cross-margin lending, multi-current lending, and other highly flexible yield strategies.

The Alpaca team decided to launch on BNB Chain due to the prohibitive costs of Ethereum and the lack of a leveraged yield farming chain protocol in the popular blockchain ecosystem. The project carried out an honest launch without investors, pre-mining and pre-sales. Those who help create the ecosystem are rewarded using the platform's economic and governance token – ALPACA.

Alpaca Finance Key Products

Committed to introducing DeFi enthusiasts to numerous opportunities, Alpaca Finance offers a wide range of products designed to make investing simple, profitable and effective.

In its first version, AF1.0, the platform focused on leveraged lending. However, Alpaca then updated its version to AF2.0 to include more products. With the move to AF2.0, Alpaca Finance has announced that it will discontinue its stablecoin Alpaca USD (AUSD) and users will need to switch to BUSD.

Alpaca's main products are

yield farming

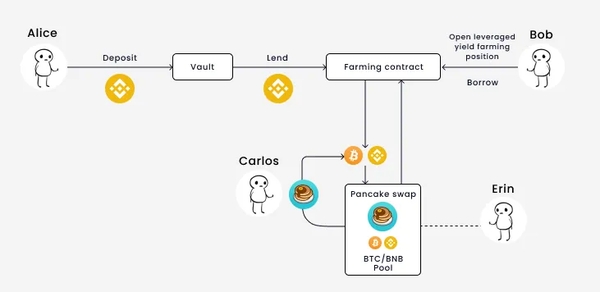

Alpaca Finance has entered the DeFi market by offering a unique product that is not available on the BNB Chain network, namely “high yield farming”. This product allows users to enter into leveraged crop farming positions with annual returns of up to six times their capital. The three main components of the Alpaca product are lenders, farmers and liquidators.

Lenders place their assets in Alpaca's credit vaults to generate safe and stable returns through the fees earned on leveraged positions. Crop farmers can borrow from these credit vaults and use the borrowed assets to open leveraged positions to produce crops up to 6x (the mechanics of this process are powered by Alpaca smart contracts).

The liquidator then helps monitor the status of all leveraged positions based on specified parameters. If the position exceeds these parameters, the liquidator proceeds to liquidate it and receives a fee of 5%. Fully 100% of the reward received goes towards the redemption and burning of ALPACA, allowing token holders to continue to benefit from the growth in value of their ALPACA tokens even when positions are liquidated.

The leveraged yield farming product currently supports BNB, ALPACA, CAKE, ETH, BUSD, USDT and USDC. To support this product, Alpaca has integrated with PancakeSwap and Biswap.

loans

Alpaca's Lending product offers another strategy for making a profit. You can lend to your assets to consistently earn high returns as Alpaca's innovative technology allows borrowers to leverage capital with amazing efficiency by providing secured loans to grow crops. Escrowed tokens are not locked and there are no deposit or withdrawal fees, providing lenders with flexibility and peace of mind.

Once you provide your crypto assets to borrowers, you will receive Alpaca ibTokens, which represent and track your share of assets contributed to lending pools. Once you deposit BNB into the Alpaca lending pool, you receive ibBNB tokens that earn interest over time. The longer you hold your ibTokens, the more valuable they become.

Automated storage

Automated Vaults (AV), an innovative product from Alpaca, implement complex investment strategies on your behalf. Think of AB as an on-chain hedge fund. AB on Alpaca operate according to one of the following plans:

Market-neutral strategy - AB approaches work with borrowed capital, minimizing market risks while ensuring high returns. This way you can work with high APY couples at low risk.

Thrift Vault Strategy – AV enters a 1x Long position, placing underlying assets such as BTC and BNB in a manner that will generate high returns without the risk of liquidation. This works similar to lending and staking, but with a higher APY. To eliminate the risk of liquidation, AB borrows and rebalances multiple assets before placing them in a long position.

Alpaca's AV systems have gone through two versions and are now in a third, AVv3, which brings together the concentrated liquidity of decentralized exchanges (DEXs), including Uniswap. Key features of AVv3 include variable leverage, chain-only trading, auto-hedging, auto-compounding, zero liquidation risk, modular design (compared to AVv2) and no lock-ins.

Governance Vault

Governance Vault is a model designed to incentivize users to lock up their ALPACA tokens, resulting in them receiving xALPACA tokens that entitle them to rewards and voting rights. The design of the model was borrowed from the CurveDAO governance framework. You can lock your tokens for anywhere from seven days to one year. The longer you hold them, the more xALPACA tokens you will earn. Rewards are distributed weekly.

Perpetual Futures Exchange

The Alpaca Perpetual Futures Exchange allows investors to open trading positions without an expiration date. Instead of the position expiring, you continue to pay fees to keep it open. This design avoids the cost and hassle of rolling over a position after it expires.

In addition, it provides operational hedging, as it allows you to quickly adjust your position depending on the market situation. Another significant advantage of Eternity is that it aggregates deep liquidity, which provides high leverage even for large trading positions.

The Alpaca Perpetual Futures Exchange consists of traders and liquidity providers. As a trader, you can open long/short positions with high leverage up to 50x without slippage at minimal cost and without the risk of centralization.

Liquidity providers, in turn, provide liquidity through an index fund consisting of major cryptocurrencies such as BNB and ETH, and stablecoins such as USDT and USDC. In turn, you earn profitability through various fees charged when borrowing, swapping and adding/withdrawing the liquidity pool. Of the 16% commission received, 10% is used to buy back ALPACA tokens and distribute them as rewards to users who stake in Governance Vault, and 6% goes to weekly buybacks and burns.

Alpies

Alpies is a collection of 10 Alpaca NFTs available on BNB Chain and Ethereum. There are two types of Alpies: Dauntless (for BNB Chain) and Dreamers (for Ethereum). These NFTs can be linked between two chains and traded on NFT marketplaces such as OpenSea.

Alps can be used as profile photos or in the Alpaca “Play and Earn” game. Twenty percent of the proceeds from the sale of Alpies are donated to ALPACA holders to facilitate the token buyback and burn program. At the same time, 5% of the proceeds are donated to charities that work with real alpacas.

What is ALPACA token?

ALPACA is the native token of the Alpaca Finance platform. It entered the market as a fair launch project in 2021 with a maximum supply of 188 million tokens.

Of ALPACA's total supply, 87% was allocated to Alpaca users, 8,7% was allocated to the team for two years, and 4,3% was allocated to future strategic spending. ALPACA acts as a governance token that provides voting rights to holders, and as a utility token to pay for services that facilitate the platform's buyback and burn program.

ALPACA has a long-term deflationary design, in which the number of distributed tokens decreases over time, causing their value to increase. Additionally, the ALPACA buyback and burn program increases the price of the token over time by creating scarcity.

Alpaca Finance price forecast

As of October 19, 2023, ALPACA's price was $0,16, which is 98,21% below the all-time high (ATH) of $8,78 and 23,97% above the ATL of $0,13.

Price forecasting experts are bullish on the ALPACA token. According to PricePrediction experts, by 2025 the price ALPACA can reach $0,51 and increase to a maximum of $3,52 in 2030. At the same time, DigitalCoinPrice is cautiously optimistic looks at ALPACA, predicting that the token price could reach $0,57 in 2025 and rise to $1,65 in 2030.

Is Alpaca Finance a good investment?

Alpaca Finance has already made a name for itself in the niche of high yield trading in DeFi. As a pioneer in this sector, Alpaca has a strategic advantage for investors looking to diversify their portfolio. Its numerous income-generating products provide a wide range of investment opportunities designed to make efficient use of your capital.

In addition, the transition from AF1.0 to AF2.0 expands investor options. The new version diversifies investment baskets to include products such as Perpetual Futures Exchange and Governance Vault, and introduces over-collateralized debt to improve risk management. In addition, Alpaca continues to innovate and improve its products, as evidenced by upgrading automated vaults to attract more DeFi users.

ALPACA's deflationary tokenomics, based on a buy-and-burn scheme, will ensure that the token remains scarce. This could cause its price to rise further over time.

Based on these considerations, we believe that Alpaca Finance is a potentially profitable project and could prove quite valuable in the future. However, this is not financial advice. We strongly recommend that you conduct your own research before investing in Alpaca Finance.

Final thoughts

The needs of DeFi enthusiasts are dynamic. Alpaca Finance has developed a unique approach to meet these needs and aims to become the largest lending protocol in this space. While the DeFi world continues to evolve, Alpaca Finance is keeping pace, diversifying its operations from cultivation and high-yield lending to providing a wide range of products, including automated vaults and a perpetual futures exchange.

Whether you are a farmer, a lender or a liquidity provider, Alpaca Finance provides you with a secure and profitable way to leverage your tokens.