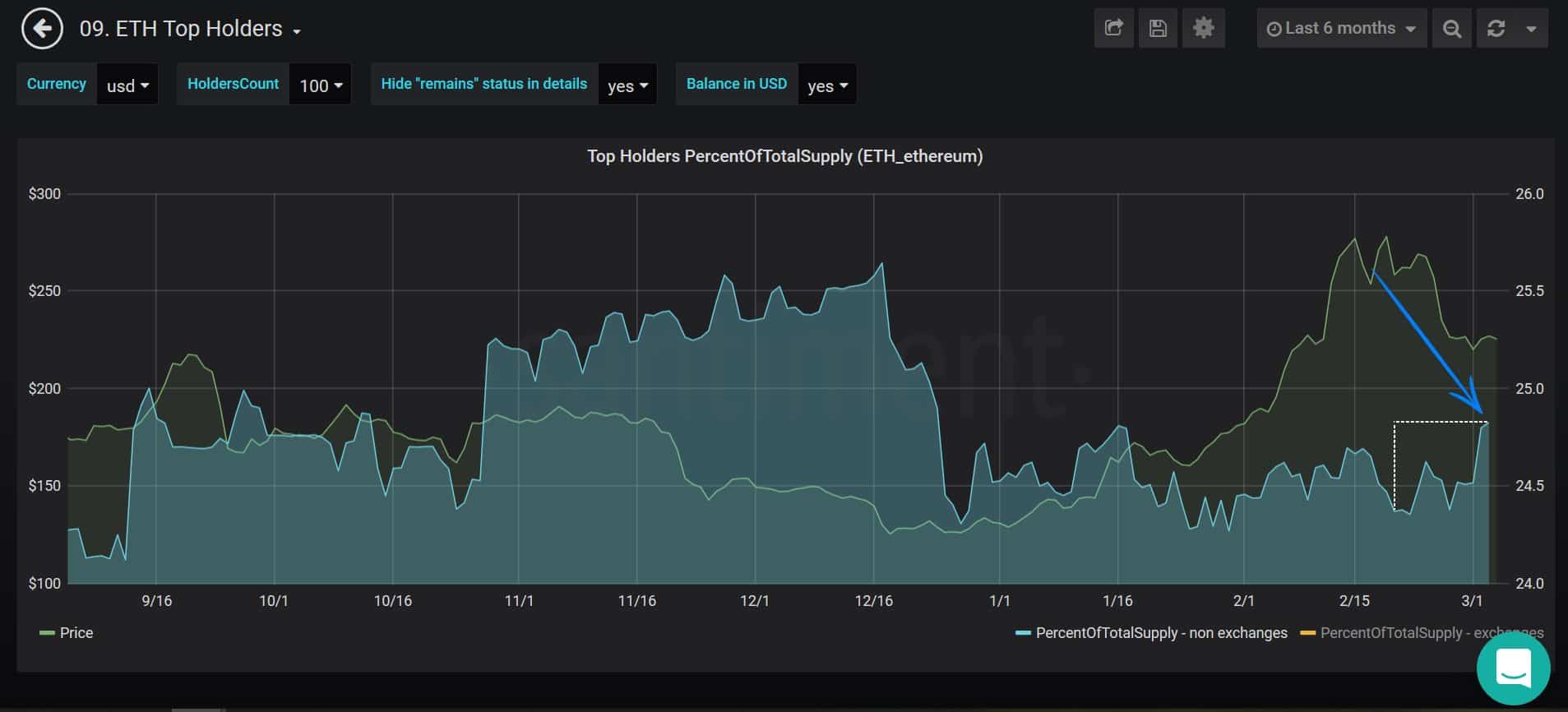

Not surprisingly, the top 100 Ethereum holders accumulated even more ETH tokens, probably due to the belief that the crypto asset is underestimated in comparison to its use and potential. In the short term, the price seems to be going down. However, major stakeholders are optimistic about the medium to long term scenarios.

The top 100 holders of #Ethereum are once again starting to accumulate higher percentages of the total supply of tokens, despite the ongoing consolidation that has taken place over the past few weeks. Usually when this kind of accumulation starts to pile up it's pic.twitter.com/Rr5C8vuE97 – Santiment (@santimentfeed) March 4, 2020

These statistics have been published by the Santiment network and are very encouraging for hitters and Ethereum traders. Ethereum Consolidation on G / L Accounts Bullish Despite Current Failures

Ethereum Statistics

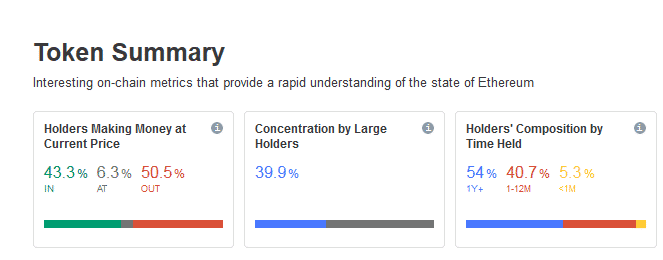

These results are further complemented by data from Into The Block, which shows that 43,3% of all accounts are in green form and making money, 6,3% are at breakeven, and 50,5% are at a loss. Losing accounts can quickly go green with a moderate rise in the price of a well-known crypto asset.

The accumulation in the upper accounts is 39,9%, a significant percentage. The measure is based on accounts, which account for 0,1-1% of the current supply.

The time holding structure shows an even better picture: 54% of accounts held ETH tokens for more than a year, 40,7% of accounts held from 1 to 12 months, and only 5,3% of accounts held for less than a month.

Ethereum Price Analysis

Ethereum price shows a bearish trend at $226. The day's low was $220 and the high was $228. If Ethereum moves up, the next significant resistance will be $235, $247, and $260. Currently, most technical indicators are selling signals.

Looking to the future

There is no doubt that major events take place on the Ethereum blockchain. DeFi recently surpassed the $ 1 billion psychological mark, but recently dropped to $ 960 million. chainlink and the DeFi Money Market (DMM) have launched a highly profitable marketplace allowing real-world assets to be used as collateral for crypto loans and presented as a digital asset Ethereum. This should creep into $ 17T cash that earns little or no interest.

Ethereum 2.0 will be deployed soon. The Aztec protocol will allow smart contracts and transactions to become private soon. Non-Fungible Token (NFT) are considered by Enjin Coin (ENJ) and Chiliz (CHZ) according to the special ERC 1155 standard, which makes it easy and efficient to mint NFT tokens. ConsenSys and EY have announced the Ethereum enterprise core protocol supported by Microsoft's software giant. The future scenario seems very favorable and optimistic for Ethereum, which seems to be believed by long-term residents.