- What is cryptocurrency mining?

- How does cryptocurrency mining work?

- Proof of Work (PoW)

- Step 1 - A new (unconfirmed) transaction is initiated on the network.

- Step 2 - The unconfirmed transaction enters the waiting area(s) called the mempool(s).

- Step 3 - Miners package transactions into candidate blocks.

- Step 4 − Miners compete to solve a computational puzzle so that their block candidate is the winner.

- Rationale for Proof of Work

- Proof of Stake (PoS)

- Cryptocurrency mining methods

- Solo mining

- Pooled Mining

- Cloud Mining

- Pros and cons of mining

- Pros of cryptocurrency mining

- Cons of Cryptocurrency Mining

- Is cryptocurrency mining legal?

- Сonclusion

Apart from buying cryptocurrency, you can also earn it in several ways. Mining is one of the most popular ways to earn cryptocurrency.

What is cryptocurrency mining?

Cryptocurrency mining is the process of using the computing resources of your computer or hardware to provide network consensus on a blockchain.

By participating in cryptocurrency mining, you can help the blockchain platform protect its activities from hostile takeovers, spam, and attempts to centralize operational control in the hands of a small number of network agents.

Best of all, you can earn significant crypto rewards from participating in mining by investing your resources in these noble causes.

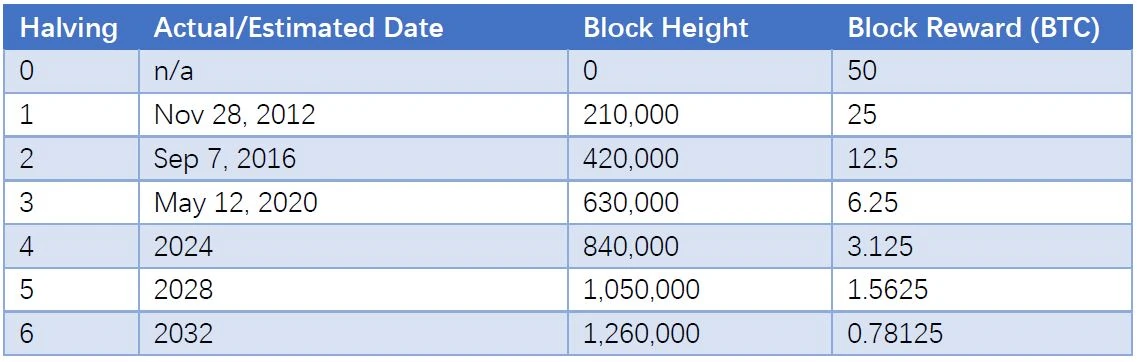

Although mining cryptocurrencies is a very competitive process, its potential rewards cannot but rejoice. For example, currently the reward for mining one block on the Bitcoin (BTC) blockchain is 6,25 BTC (more than $140 at the current market price of the coin). This reward is scheduled to be halved approximately every four years, although the rise in BTC's monetary value over time helps offset the decrease in reward.

Rewards for Bitcoin blockchain and halving dates:

To become a cryptocurrency miner on the blockchain platform, you will need the appropriate mining hardware. By now, given the competitive nature of mining cryptocurrencies, the standard hardware required for mining is usually a machine integrated circuit (ASIC) – a powerful computer specifically designed for mining. Some chains may also use powerful GPUs on the PC.

How does cryptocurrency mining work?

There are two main types of blockchain based on the transaction verification method used: Proof of Work (PoW) or Alternative Proof of Stake (PoS). Mining is the activity associated with verifying transactions on PoW blockchains.

PoW chains that use the mining procedure include, in particular, two of the world's leading networks - Bitcoin and Ethereum (ETH).

Proof of Work (PoW)

PoW is a computational procedure used to validate and add blocks of transactions to the blockchain's permanent ledger. In PoW blockchains, special network nodes called miners collect transactions into packets/blocks and then use the hash power of their computers to try to “solve” the computational puzzle that will “validate” the block. The confirmed block is then permanently added to the blockchain.

Brief description of PoW sounds like a concept from a rocket science textbook, doesn't it? While PoW is indeed quite a technical process, it can be easily understood by looking at its implementation step by step. For our step-by-step description, I will show how bitcoin mining works, although the general principle applies to all PoW chains.

Step 1 - A new (unconfirmed) transaction is initiated on the network.

Initially all Bitcoin transactions receive the status of an unconfirmed transaction. When two users make a transaction on the blockchain, for example, one sends cryptocurrency to the other, a new unconfirmed transaction is generated on the network. The transaction contains key records such as the sender's address, the recipient's address, and the amount sent. The transaction is broadcast throughout the network.

Step 2 - The unconfirmed transaction enters the waiting area(s) called the mempool(s).

Bitcoin miners constantly monitor the network for new activity. Each miner has a temporary area on his machine where unconfirmed transactions go after appearing on the network in accordance with step 1. This temporary area is called mempool (memory pool).

Contrary to popular belief, there is no single pool of memory on the network. Each miner has its own memory pool. The memory pools of the two miners may differ slightly as each node is built differently and receives unconfirmed transactions at different times, although the default memory pool size cannot exceed 300MB.

Step 3 - Miners package transactions into candidate blocks.

Miners regularly select transactions from their pools and pack them into so-called “candidate blocks”. In Bitcoin, the average candidate block is about 2 MB, which holds approximately 2 transactions.

Since miners can have slightly different contents of the memory pool, the composition of candidate blocks varies from miner to miner.

Step 4 − Miners compete to solve a computational puzzle so that their block candidate is the winner.

The actual PoW process begins in step 4. After packing their candidate blocks, each miner uses their machine to repeatedly add a small number, called a nonce, to another number generated by the network software. The resulting number is then put through the hashing algorithm used in Bitcoin called SHA-256.

The hashing algorithm is designed to cryptographically modify the input data and obtain a modified output value. This output value must be equal to or less than the defined system-generated target value, which is constantly updated with the blockchain code. If this happens, the candidate block is considered “resolved”, i.e. its status moves from candidate to fully verified block.

The verified block is added to the blockchain as the next entry in the ledger. The miner who solves the block receives a reward, which for Bitcoin is currently 6,25 BTC.

Each miner competes to be the first to match the target value and make their block the winner. To do this, miners, or rather their computers, repeat the process of adding the nonce value a huge number of times, trying to do it as quickly as possible.

The more nonce substitutions (hashes) you can make per second, the higher your statistical chances of winning. Today's powerful ASIC computers (see above) are capable of adding hundreds of trillions of hashes per second.

This race to solve the next block in the chain is repeated in Bitcoin every 10 minutes. When a winning block appears, miners quickly stop their attempts to solve the current candidate block, update their mempools to remove confirmed transactions, collect another candidate block from the available unconfirmed transactions, and restart the race to be the first to add the next block to the chain.

Rationale for Proof of Work

The computational struggle between miners for new blocks in the chain is an extremely energy-intensive process. It also significantly slows down the computing power of the network. You may wonder why the network is subjected to this seemingly pointless and time consuming procedure.

The main point of using PoW is to protect the network from spam transactions and, very importantly, from attempts to take over the network, that is, to violate its decentralized nature.

On a blockchain-wide scale, PoW requires so much energy and hash power that no single entity, person, or group can realistically solve all or most of the blocks in the network.

Thus, PoW is a key element in ensuring that the blockchain remains decentralized and free from the control of a small number of entities.

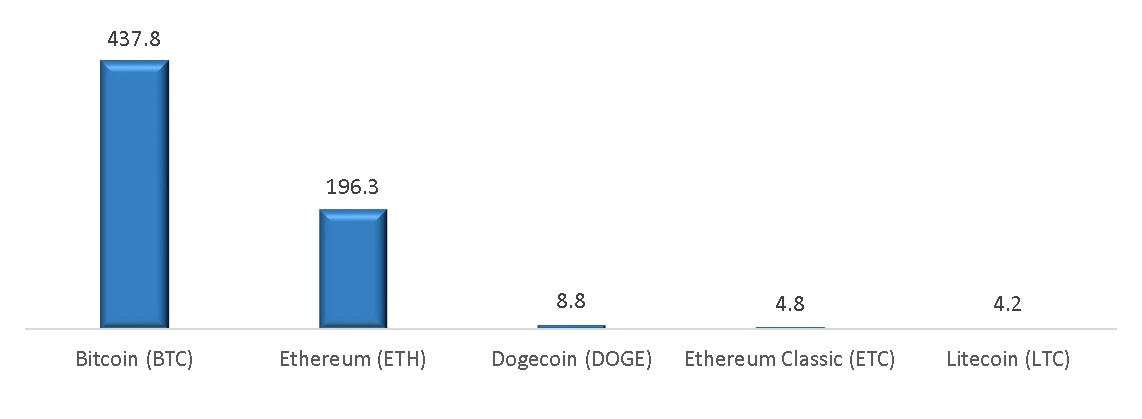

Popular PoW-based blockchains include Bitcoin, Ethereum, Dogecoin (DOGE), Ethereum Classic (ETC), Litecoin (LTC), Bitcoin Cash (BCH), and Monero (XMR).

Top 5 proof-of-work cryptocurrencies by market value (in billions of US dollars) as of August 2022:

Proof of Stake (PoS)

PoS is the main alternative to PoW for confirming transactions on the blockchain. In the PoS model, there is no computational race to solve blocks of transactions. Each new raw block on the network is allocated to a validator node, which validates it and adds the block to the chain.

According to the most basic PoS model, this distribution to a validator node is random, and the probability that the validator will receive the next block to process is directly dependent on the share of the native cryptocurrency of the chain that this node owns or staked on.

For example, if you own 3% of all cryptocurrencies on the network, you will get a chance to confirm about 3% of all blocks.

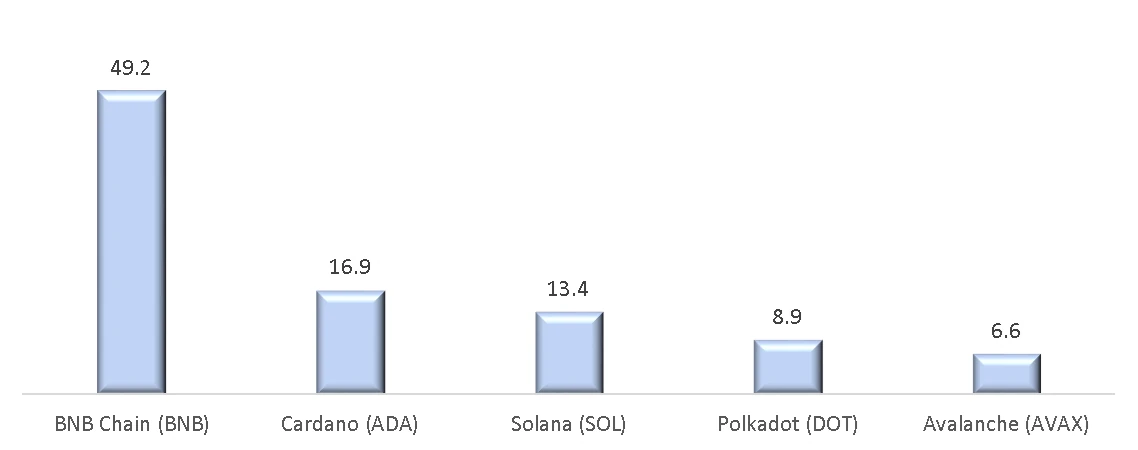

Unlike PoW, PoS does not require significant power consumption and does not slow down the network. Some of the popular blockchains using PoS include Binance Chain (BNB), Cardano (ADA), Solana (SOL), Tron (TRX), and Avalanche (AVAX).

The second largest chain in the world, Ethereum, plans to migrate from the current version of PoW to a new PoS platform. Ethereum 2.0, over the next few weeks or months.

Top 5 proof-of-stake cryptocurrencies by market capitalization (in billions of US dollars) as of August 2022:

Cryptocurrency mining methods

There are three main cryptocurrency mining methods for confirming transactions and earning cryptocurrency rewards in the process:

- Single mining

- Joint mining

- Cloud Mining

Solo mining

Solo mining is exactly what the name suggests: you purchase the necessary mining equipment, join the blockchain network as a node, download the required software, and try to mine blocks yourself. If you manage to mine a block, you receive a mining reward without having to share it with other network members.

While (theoretically) you can use your computer's CPU or GPU to mine cryptocurrency, this is already impractical and unprofitable given the fierce competition between miners on most popular PoW chains. For profitable mining, your real choice is limited to ASIC machines.

On chains as popular as Bitcoin, single mining – even with a powerful ASIC machine – can be difficult due to competition from mining pools. These are groups of network participants that pool the resources of many individual miners to dominate the mining activity.

Online calculators (for example, WhatToMine.com) will help you evaluate the difficulty of mining and the profitability of various networks. On these sites, you can enter the characteristics of your ASIC rig, electricity rates, the circuit you would like to mine, and other necessary parameters. They then issue profitability calculations.

Pooled Mining

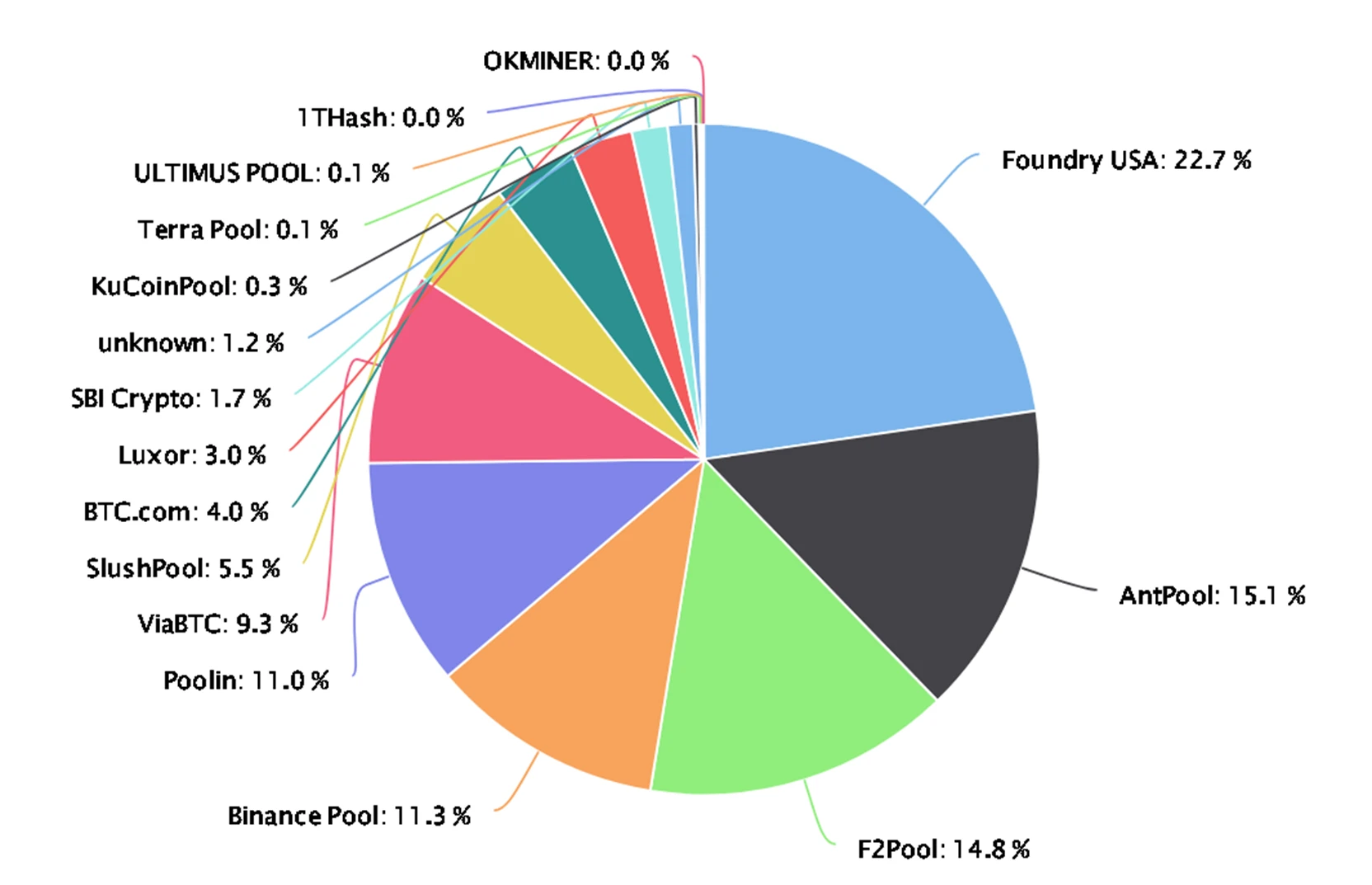

A mining pool is a large group of individual miners who pool their computing resources to increase the likelihood of cracking the next block in the chain. Large mining pools can have many thousands of people who put their hash power into collaborative work.

Distribution of Bitcoin mining activity by pools - for 30 days as of August 2022

When a block is solved by any member of the pool, the mining reward is divided among all members of the pool in proportion to their contribution to the hash power. By pooling the resources of a large number of computers, mining pools are significantly more likely to solve a block than single miners.

If you are going to be mining Bitcoin or other popular cryptocurrencies like Dogecoin and Litecoin, we strongly recommend that you join a large enough online cryptocurrency mining pool rather than trying to work alone. A good pool can make Bitcoin mining profitable even if you don't have the most powerful rig on the network. Although your rewards will come in smaller amounts, at least they will come with a certain degree of consistency.

Conversely, if you are mining alone, your rewards may come in very infrequently or not at all given the fierce competition on the leading PoW chains.

Cloud Mining

Single mining and joint mining require own mining equipment. Instead of buying hardware, you can participate in mining by joining a cloud mining platform. Cloud mining platforms charge users a monthly or yearly fee for being able to rent their internal mining hardware resources.

In exchange for a fee, the cloud platform performs mining operations on the blockchain network on your behalf. Any rewards received as a result of mining are shared between you. The higher the fee, the more hash power you can rent, and therefore the higher your reward will be.

The cloud mining model looks very attractive as it frees you from having to own a mining rig. However, before you decide on it, carefully study the rates and reputation of cloud mining providers in the market. In this niche, finding a reliable long-term provider with low rates can be a challenge.

Pros and cons of mining

Pros of cryptocurrency mining

The biggest advantage of cryptocurrency mining is undoubtedly the ability to earn cryptocurrency rewards. Cryptocurrency mining can be an energy-intensive process, but it is usually done in a “hands-free” mode, meaning you don’t have to actively monitor what is happening on the network.

In a practical sense, you simply keep your rig running on autopilot. Thus, mining can be a great way to generate passive income.

Another advantage of mining is more of an altruistic nature - you get the opportunity to contribute to keeping the decentralized network free from hostile takeovers.

Cons of Cryptocurrency Mining

Along with the advantages, cryptocurrency mining has certain disadvantages and risks associated with it. One of them is the volatility of mining profitability. The competition between miners on the leading PoW platforms is very fierce, making cryptocurrency mining an uncertain and fickle activity in terms of profitability. Today you can make a profit, but if the competition on the network suddenly increases, tomorrow you may find yourself in the red.

Another disadvantage is the initial cost of equipment to participate in cryptocurrency mining. Powerful ASIC rigs that can give you a good chance of profitable cryptocurrency mining cost at least $3, which is way more than your average PC costs. Regardless of the price you pay for your mining rig, remember that profitability will fluctuate and there are no guarantees of profit in this game, even with powerful machines.

In addition, the extremely energy-intensive nature of mining can create environmental problems. Bitcoin Blockchain consumes more energy per year than a country as large as Argentina, South America's second largest economy. By participating in the mining of cryptocurrencies, you definitely will not make friends with environmental activists.

In addition to the environmental impact of the entire blockchain, the energy-intensive process of mining cryptocurrencies will add some serious numbers to your own electricity bills.

Is cryptocurrency mining legal?

While cryptocurrencies and trading in cryptocurrencies are banned in a number of countries, very few countries in the world have explicitly banned the mining of cryptocurrencies. The most famous example of a country where cryptocurrency mining is prohibited is is China. The Chinese authorities have repeatedly suppressed mining activities in the People's Republic. Any form of activity related to cryptocurrencies, including mining, is prohibited in the country.

Another rare country where cryptocurrency mining is banned is Kosovo. The ban was largely due to the lack of energy in the Balkan state.

Venezuela made mining of cryptocurrencies illegal, but only if the mining takes place in public residential premises owned by the state. Cryptocurrency mining outside these premises is not illegal. For example, special installations for mining cryptocurrencies used in industrial premises are not subject to this ban.

In the last couple of years Iran introduced temporary multi-month bans on cryptocurrency mining. The last of these bans was in effect until March 2022. However, in general, cryptocurrency mining is not illegal in the country.

In addition to the above countries, as of the beginning of August 2022, no other country has recognized cryptocurrency mining as illegal. India and Russia are considering legislation that could restrict most crypto-related activities, including mining. However, this legislation has not yet been adopted.

Сonclusion

Cryptocurrency mining can be profitable if you have powerful mining hardware and choose profitable coins/networks. However, it is an unstable game with increasingly fierce competition between miners on popular networks. This competition is constantly raising the bar on minimum equipment specifications for profit. For most people who want to profit from cryptocurrencies, it is easier to find other sources of passive income from cryptocurrencies or just get into trading cryptocurrencies.