While decentralized finance (DeFi) may offer endless possibilities, some challenges may prevent it from reaching its goal of rivaling the current centralized economic system. One of them is the incompatibility of the main cryptocurrency, bitcoin, with the main decentralized applications that make up the decentralized ecosystem.

This is where Wrapped Bitcoin (WBTC) comes in. The main idea is to develop a digital currency, which is Bitcoin on the Ethereum blockchain. Read on to find out how it works.

What is Wrapped Bitcoin (WBTC)?

Wrapped Bitcoin (WBTC) is an ERC-20 token whose value is pegged to Bitcoin. This means that he is a bitcoin representative that can run on the Ethereum blockchain. It is one of the most well-known “wrapped” tokens available in the DeFi ecosystem due to Bitcoin’s reliability.

Assets are “wrapped” so that they can be used in other blockchain networks where they cannot function. Just as astronauts need to be wrapped in tight spacesuits to survive outside their natural habitat, Earth, BTC needs to be wrapped to make Bitcoin work on other blockchains.

Wrapped tokens are necessary due to the features and applications that various blockchains offer. For example, unlike Bitcoin, the Ethereum blockchain contains smart contracts that allow decentralized applications (DApps) to run on it. However, native tokens can only be used within native blockchains. Token wrapping serves to facilitate the use of crypto assets on non-native blockchains.

Wrapped Bitcoin (WBTC) vs. Bitcoin (BTC)

The relationship between wrapped bitcoin and bitcoin is similar to the relationship between Tether (USDT) and the US dollar: The value of USDT is pegged to the value of the US dollar.

So why do we need USDT if it has the same value as the US dollar?

Although they have the same value, the US dollar is a fiat currency issued by a sovereign body, the US government, through the Treasury Department, which means you cannot use it for cryptocurrency transactions. Therefore, a crypto version of the American fiat appeared - USDT stablecoin, which can work in blockchain networks.

The same is true for Wrapped Bitcoin and the “regular” Bitcoin that everyone knows – except that both are used for cryptocurrency transactions. However, the importance of Wrapped Bitcoin lies in the cross-chain functionality it offers to Bitcoin holders.

For example, if BTC holders want to stake their bitcoins on a DeFi platform (for example, Aave) to earn interest, they need to use Wrapped BTC, as AAVE tokens are only used on the Ethereum network, and Wrapped BTC are ERC20 tokens. Thus, wrapped tokens can be used on the Ethereum network.

How Does Wrapped Bitcoin Work?

There are two ways to get WBTC tokens. You can either mine them, or buy them on a decentralized or centralized exchange (which usually means a higher fee).

The Wrapped Bitcoin mining process includes two main operations - mining and burning.

To mine WBTC, you need to submit a request and make a payment to a WBTC merchant, such as Loopring or DeversiFi. The seller then makes a transaction with the custodian, who mines the token by sending Bitcoin in exchange for WBTC. The custodian locks the bitcoin in reserve and stores it.

In order to redeem your bitcoins, you will need to pay another small fee to the seller, who will then initiate the burn operation with the custodian. The custodian will release bitcoin and burn WBTC.

The transaction is tracked and verified on the Ethereum blockchain and can be seen publicly through a blockchain explorer like Etherscan.

The problem created by the oversupply of wrapped Bitcoin is solved by the above process. Since the maximum supply of Bitcoins is limited to 21 million coins, the total possible supply of wrapped cryptocurrencies is also limited to this amount - because WBTC tokens can only be minted after ownership of the corresponding Bitcoin has been confirmed. Thus, each token is pegged to the corresponding Bitcoin.

This procedure mimics the process of lending to institutionalized banks, in which users in need of loans must temporarily grant the bank ownership of their assets of equal or greater value. After the loan is repaid, the ownership of the asset is restored. But in this case, the value of the two assets is linked, so any depreciation or appreciation is reflected in both assets.

WBTC Tokenomics

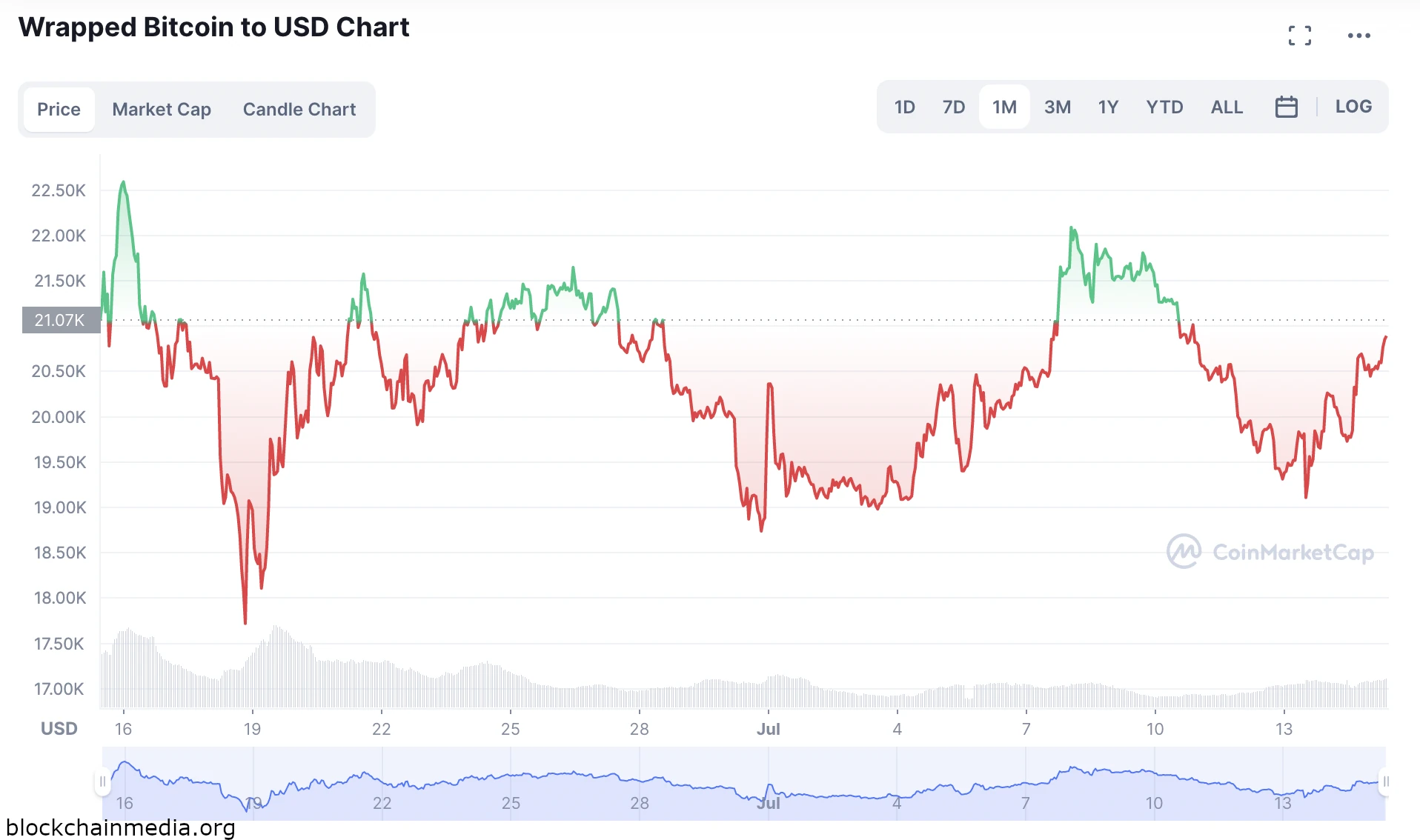

Note: The figures below are accurate at the time of writing and are calculated to two decimal places.

Maximum offer - not available

The circulating supply is 0,24 million WBTC

Market value – $20,884.47

Market capitalization - $ 4,99 billion

Trading volume for 24 hours - $258,80 million.

pros

Higher transaction speed

Wrapped bitcoins do not work on the Bitcoin network. Therefore, their block speed – the speed of the network – is based on the Ethereum blockchain, not the Bitcoin blockchain. Ethereum takes significantly less time to validate blocks to be added to the blockchain, so transactions on the network are faster.

In this way, WBTC helps its owners to transact faster than those using real Bitcoin.

Lower fees

Transaction fees in Ethereum are lower than in Bitcoin to encourage developers to use the network. Thus, WBTC holders can conduct transactions cheaper than those who own BTC.

For example, if a user intends to make several transfers of funds, he will prefer to use WBTC, as in this case he will pay less for each transaction. The difference in fees is due to the level of congestion in the Bitcoin network. Transactions on the Bitcoin network are clogged, resulting in increased block clearing fees, while on Ethereum, the clearing speed is faster.

Interchangeability

WBTC offers the ability to easily move your crypto assets between blockchains. The interoperability issue has been a formidable issue for cryptocurrency users, especially in the DeFi space.

However, such cryptocurrencies, including WBTC, are a viable solution to this problem due to their interoperability. This feature means that users do not need to sell some of their bitcoin holdings in order to access DeFi services on Ethereum. At any time they wish, they can get their coins back, even after “exchanging” them for Ethereum tokens.

Cons

Security questions

Since the process of mining cryptocurrency is similar to the process of centralized bank lending, users have to trust that the custodians will not run away with their bitcoins. This is contrary to the purpose of a decentralized system, which is the raison d'être of cryptocurrencies.

The recent emergence of blockchain technology has helped overcome this security issue. BadgerDAO, a decentralized autonomous organization (DAO) dedicated to making Bitcoin easier to use, aims to solve this problem with its Badger Bridge, which allows cross-chain asset interconnection to seamlessly exchange BTC for WBTC. The mining process is completely decentralized, as is the Ethereum (WETH) mining process, which can be mined using smart contracts. Threshold Network introduces another form of wrapped BTC with its tBTC, which decentralizes BTC not only to Ethereum but also to other blockchains like Celo.

Is Wrapped Bitcoin (WBTC) a good investment?

The benefits of Wrapped Bitcoin in the form of higher transaction speeds, lower cost, and most importantly, cross-chain operability will surely fuel the growth of DeFi as users will be able to make payments and access financial services and general utilities easier, faster, and cheaper. . Using WBTC is an impressive way to make DeFi as easy as centralized financial services without sacrificing the untethered nature of Bitcoin.

Even if another innovation turns out to be a better solution for cross-chain transactions, wrapped cryptocurrencies effectively solve the interoperability problem and will be noticeable for a long time. What token looks more promising than Wrapped Bitcoin, a derivative of the largest cryptocurrency by market cap?

Final thoughts

The world of cryptocurrencies continues to move towards efficiency, flawlessly secure transactions, easily accessible services and simplicity that will allow it to leave the margins of the economy and dominate the global economic arena.

Therefore, innovation is constantly required to overcome the obstacles or problems that hinder its path to mass adoption. Wrapped cryptocurrencies are one such innovation.

The idea that it is possible to duplicate assets for transactions on other blockchains without causing them to be overproduced is a sign that DeFi can no doubt solve the problems that many fear could stop it in its tracks.

Truly decentralized finance is just around the corner – and what better sign of that than the representative asset of Bitcoin itself?